In today’s complex financial world, managing money effectively is crucial. Yet, for many rural and tribal families in India, accessing financial literacy remains a distant dream. Limited knowledge about financial tools and digital transactions makes saving and planning for the future a significant hurdle.

Recognizing this challenge, the Nagpur Zilla Parishad (ZP) administration, led by CEO ZP, IAS officer Saumya Sharma, in collaboration with Swatah Education Foundation and Zerodha, launched a groundbreaking initiative to integrate financial literacy into school curricula.

Indian Masterminds exclusively spoke with the officer to learn how this program is empowering students, fostering financial independence, and shaping a brighter future for generations to come.

PROMOTING FINANCIAL LITERACY AT THE GRASSROOTS

Recognizing the importance of financial literacy for a secure future, the program was designed with a four-pronged approach. Firstly, it equips students in both primary and upper primary schools with the necessary financial knowledge.

Secondly, it focuses on empowering students in grades 5 to 9 with practical financial skills. The program also aims to cultivate a culture of responsible money management among students, encouraging them to consider saving, investing, and even entrepreneurship.

“To ensure effective delivery of financial education, we also prioritize enhancing teachers’ capacity to confidently lead these discussions,” stated the officer.

IMPLEMENTATION STRATEGY

The program’s success hinges on a well-defined implementation strategy:

Curriculum Development: A comprehensive curriculum, tailored for each grade level, was developed with the District Institute of Education and Training (DIET) and partner organizations. Topics like economic planning, savings, banking operations, loans, and interest rates are covered in fun, activity-based sessions.

Teacher Training: A two-pronged approach ensured comprehensive teacher training. First, 200 Super Trainers received in-depth training. They then cascaded their knowledge to all teachers handling grades 5 to 9 through multiple training sessions and online doubt-solving sessions.

Embracing Technology: The Vinoba App, an internal platform for ZP teachers, facilitated seamless communication and curriculum dissemination. The app housed the curriculum, enabled progress tracking, and promoted a paperless approach.

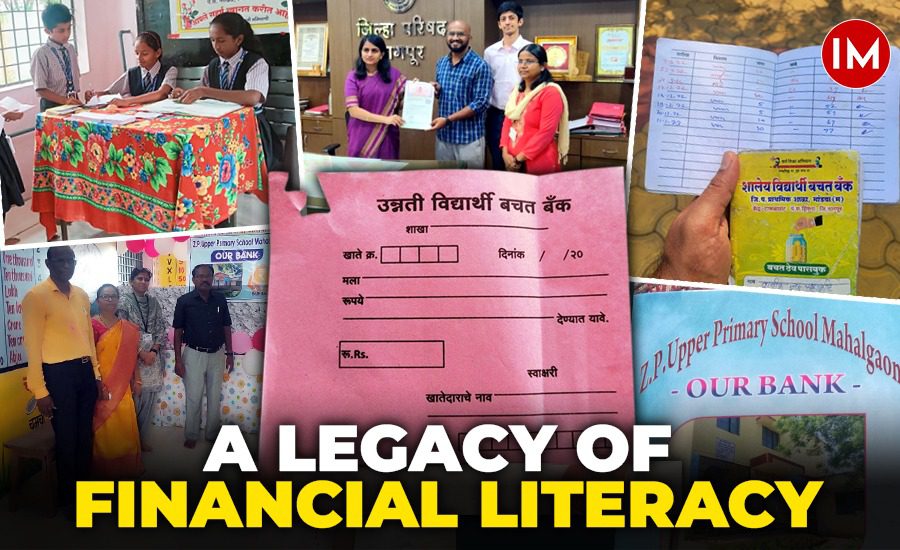

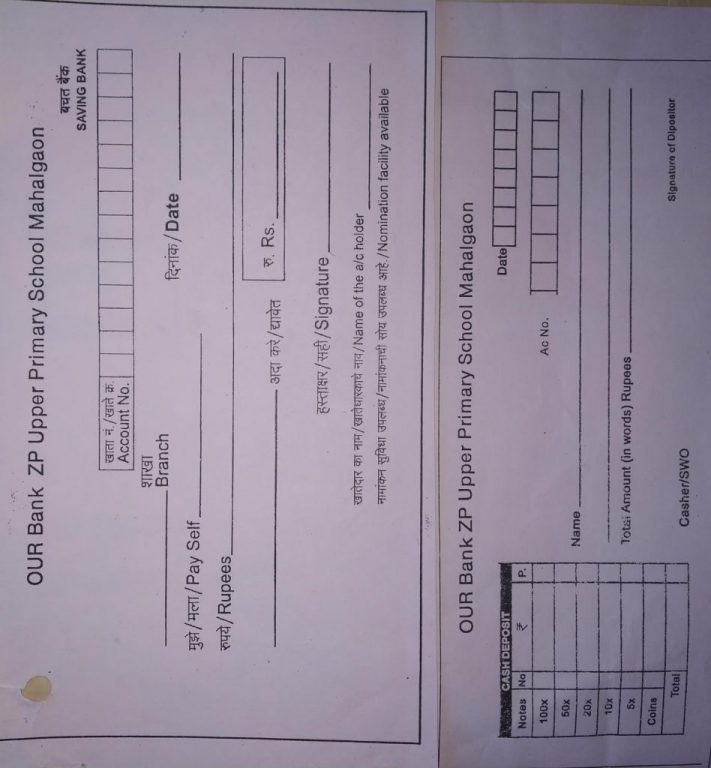

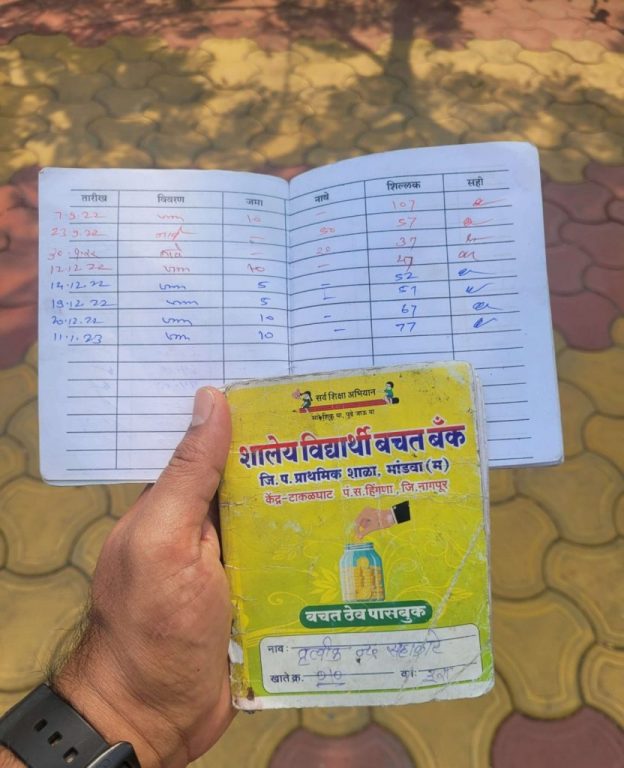

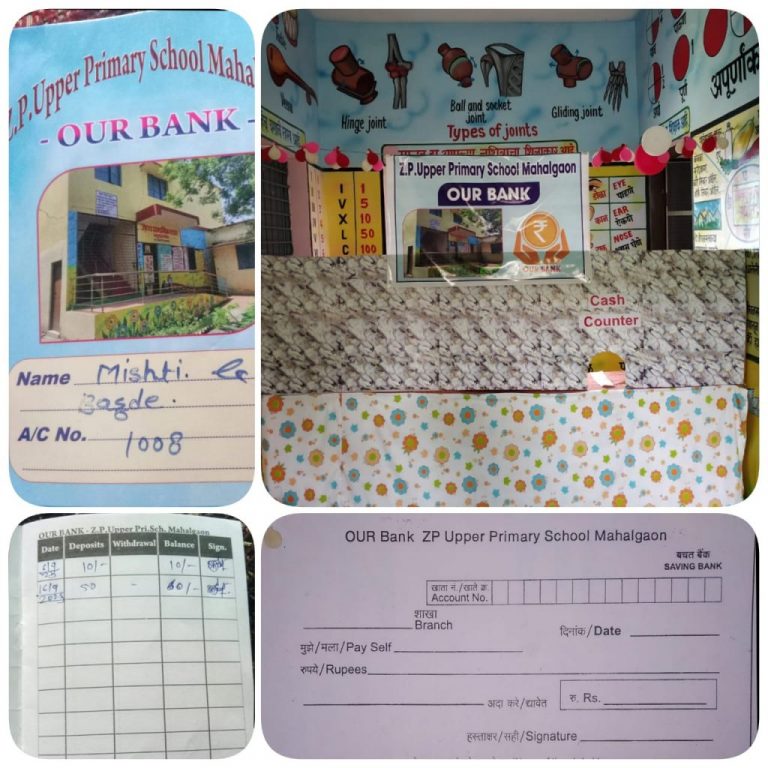

Interactive Learning in Schools: Trained teachers led engaging discussions, using educational materials and activities tailored to each topic. The program went beyond theory, establishing student-run savings banks within schools. Students actively managed these banks, learning essential banking transactions like deposits, withdrawals, and even internet banking basics.

SHAPING FINANCIALLY SAVVY YOUNG MINDS

The program’s impact has been far-reaching. Students displayed a significant boost in confidence and financial literacy thanks to the hands-on experience gained through the program.

Assessments conducted across hundreds of schools with over 15,000 participants revealed a remarkable improvement in learning within just a year. Furthermore, schools, with the help of the community, established student-run saving banks. This initiative provided students with invaluable firsthand experience with real-world banking functions, including deposits, withdrawals, and even basic internet banking. The program wasn’t limited to students – parents, even those with limited education, actively participated and benefited from their children’s learning.

“Perhaps most remarkably, students have begun to consider careers beyond traditional paths, with some setting their sights on the exciting world of banking and the stock market,” Ms. Sharma told Indian Masterminds.

CASE STUDY: ZILA PARISHAD UPPER PRIMARY SCHOOL, MAHALGAON

This case study exemplifies the program’s effectiveness. Students at Zilla Parishad Upper Primary School, Mahalgaon, successfully launched their own bank under teacher guidance.

Over 130 students collectively deposited approximately INR 60,000, gaining practical experience in various banking transactions.

“Creating and printing passbooks and receipts further enhanced their understanding and confidence in managing finances.”

A SUSTAINABLE FUTURE

The financial literacy program has garnered enthusiastic participation across Nagpur district. The success paves the way for expansion and replication in other districts. This has the potential to significantly contribute to the holistic development of students, particularly those in rural Zilla Parishad schools, enabling them to compete with their urban counterparts.