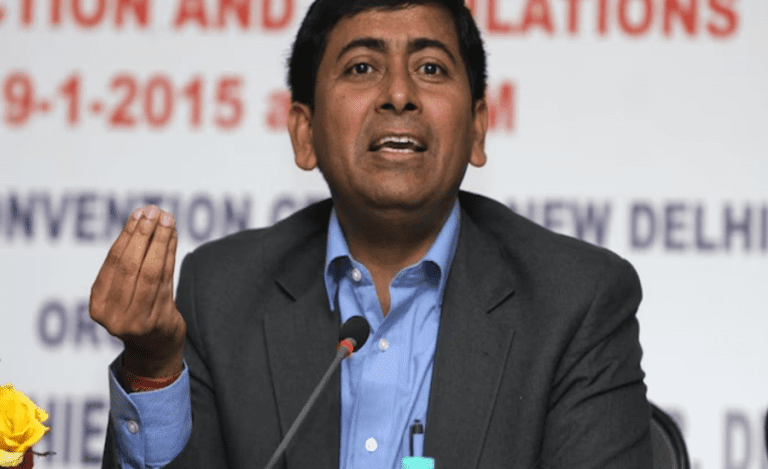

In the complex world of taxation, financial investigation, and forensic auditing, IRS officer Smarak Swain has carved a niche for himself. But beyond his career as a skilled investigator lies another fascinating dimension—Swain is also a prolific author. His knack for weaving intricate case studies into compelling narratives has gained him recognition both as a tax investigator and as a writer. Swain’s unique journey from auditing multinational corporations (MNCs) to writing racy pulp fiction and academic textbooks clearly indicates his ability to blend his profession with his passion for storytelling.

In an exclusive conversation with Indian Masterminds, the officer shared details about the same.

A WRITER AT HEART, BORN FROM A LITERARY LEGACY

For Smarak Swain, writing seems to run in his veins. His father, an accomplished writer who authored over 70 books in the Odia language, instilled in him a love for literature at a young age.

“I grew up organizing my father’s research, helping him collect notes and materials. That’s when I realized I wanted to try my hand at writing,” Swain recalls.

The environment of creativity and storytelling was deeply embedded in his upbringing, making his foray into writing a natural progression. He adds, “I love narrating stories and I felt that books were an interesting way to share my experiences and insights with the world.”

Swain’s career in financial investigation exposed him to a wealth of stories—anecdotes and case studies that he could not resist transforming into books. “The more I worked on cases, the more I realized that these were stories waiting to be told,” he says.

FROM TEXTBOOK TO THRILLER: AN AUTHOR’S JOURNEY

Swain’s writing journey began with a textbook, published in 2010. As an aspiring civil servant, he had chosen psychology and sociology as his optional subjects in the UPSC exam. While preparing, he found a gap in the resources available for Psychology Paper 2: Application of Psychology to Indian Context.

“There wasn’t a single comprehensive book on the subject. Students had to gather content from various libraries, which was time-consuming. So, I decided to write one,” he told Indian Masterminds.

Swain dived into research, combing through more than 80 books, and ultimately wrote the much-needed textbook in his own words. “With the right footnotes and references, I was able to compile a book that students still use today,” he proudly shares.

But his writing soon took a different turn with his recent foray into fiction. One of his notable works is Hawala Agent, a fast-paced thriller inspired by real-world investigations.

“I was intrigued by the way anonymous foreign donors were funnelling money into India through NGOs with hidden agendas. In some income tax searches, we found huge cash movements through hawala operators. I merged these two real-world scenarios and crafted a story around them,” he shared.

The book gives readers a glimpse into the shadowy world of hawala operators, where money laundering and ideology promotion intersect.

MAKING TAXATION ENGAGING

For a subject as technical and dry as taxation, Smarak Swain has managed to make it engaging for his readers. In his book Loophole Games, Swain explores 100 ways people attempt to evade taxes, bringing a dull topic to life with wit and creativity.

“Taxation can be boring, but it doesn’t have to be. I wanted to make the subject accessible and even entertaining for common readers, while still being informative for professionals like CAs and lawyers,” he told Indian Masterminds.

Swain’s approach is simple: while he begins by outlining the loopholes in the tax system, he doesn’t let the reader forget that tax officers are always one step ahead. “The system may have gaps, but the taxmen are watching,” he says with a smile.

Loophole Games ends with an important reminder that authorities are aware of these schemes and can catch violators through meticulous law enforcement.

THE GREAT INDIAN FRAUD: UNMASKING FINANCIAL SCANDALS

Of all the books Swain has written, his favorite remains The Great Indian Fraud, published by Bloomsbury in 2020. Drawing on his experience in financial investigations, the book exposes the inner workings of some of India’s most notorious fraudsters—Harshad Mehta, Nirav Modi, Vijay Mallya, and many more.

“Fraud is often the result of manipulating simple financial transactions to deceive regulators, partners, and customers. In this book, I wanted to show how these frauds unfold and the simple yet devastating tricks used to carry them out,” he told Indian Masterminds.

The book not only delves into financial deception but also provides insights into how authorities uncover such schemes. “People often wonder how such massive frauds go undetected for so long. The answer is usually in the details—small but critical manipulations that can have huge impacts.”

WRITING AND WORK: A DELICATE BALANCE

Balancing a demanding career with writing is no easy feat, but Swain has found a rhythm that works for him. “I write about the topics I deal with at work every day. When you are immersed in these stories, the writing flows more easily,” he explains. Swain’s method is simple yet effective—he keeps a daily journal of the cases he handles, allowing him to maintain continuity in his writing projects.

“Whenever I can, I take long leaves to focus on writing. But even during busy periods, I steal moments to write. That’s how I manage,” he says.

Currently, Swain is working on a fiction book centered around cybercrime, which is expected to be released in 2025. “The world of cybercrime is evolving rapidly, and the stories are fascinating,” he remarks.

For Smarak Swain, the intersection of his professional life and his passion for storytelling has been a source of endless inspiration. Whether he’s uncovering financial fraud or spinning tales of hawala agents, Swain’s unique perspective ensures that his readers are in for an insightful and engaging read every time they pick up one of his books.