Singapore – Indian businesses are making significant strides in global fintech innovation at the Singapore Fintech Festival, with a focus on partnerships and technological advancements aimed at enhancing financial inclusion and customer-centric solutions. A key highlight of the event, which runs from November 6-8, was the launch of the State Bank of India (SBI) Innovation Hub in partnership with APIX, a leading global innovation platform for financial institutions and fintechs.

The SBI Innovation Hub, designed to accelerate digital transformation, offers a dedicated space for fintechs, startups, and innovators to develop next-generation financial solutions tailored to meet the diverse needs of SBI’s extensive customer base. Through this initiative, SBI aims to foster financial innovation, promote digital transformation, and advance financial inclusion.

The platform provides participants access to over 250 financial service APIs from SBI, enabling them to create and customize solutions within a secure sandbox environment. Through structured challenges, hackathons, and partnership opportunities, fintechs and startups can compete for recognition, establish official partnerships, and reach millions of users across India.

Vidya Krishnan, Deputy Managing Director of IT at SBI, emphasized the significance of the launch, stating that the hub is a key step in SBI’s digital transformation journey. “The Innovation Hub will enable mutual discovery of APIs, allowing SBI and its partners to collaborate with global innovators to build customer-centric, impactful solutions,” she said.

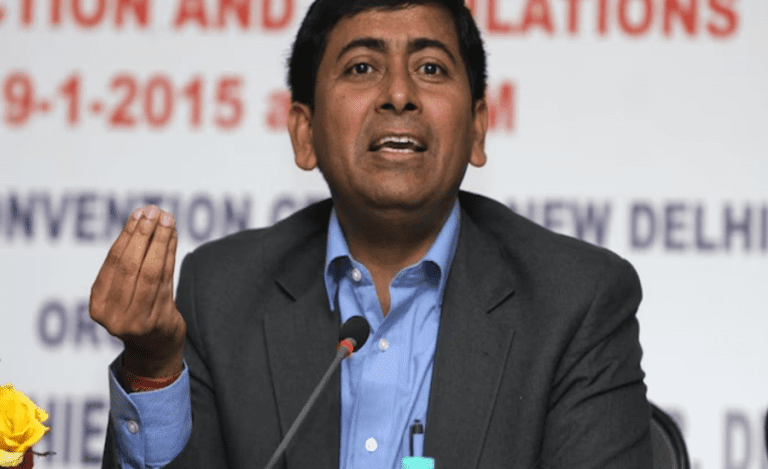

Umang Moondra, CEO of APIX, also highlighted the importance of the partnership, calling the collaboration with SBI a “tremendous achievement.” He noted that the Innovation Hub represents a groundbreaking opportunity for fintechs to engage with one of the world’s largest banks, while benefiting from access to SBI’s secure sandbox and APIs, which can empower developers to create solutions that resonate globally and promote financial inclusion.

In addition to SBI’s launch, Gupshup, an Indian-origin conversational AI company, also made waves at the festival with its growing presence in Singapore’s fintech sector. The company announced a partnership with Standard Chartered Bank, where Gupshup’s AI-powered digital assistants are enhancing customer experience by handling complex banking queries in real time.

Ali Asgar Lightwalla, Senior Director of Sales for BFSI at Gupshup, emphasized the company’s expertise in creating AI assistants that are highly contextualized for specific sectors. He noted that this approach has proven particularly valuable in Singapore’s sophisticated banking sector, where precision and regulatory compliance are crucial.

Beyond banking, Gupshup’s AI solutions are transforming customer engagement in other sectors, including retail, healthcare, and logistics, by automating customer interactions while maintaining personalization and high service quality.

The Singapore Fintech Festival continues to serve as a platform for innovative partnerships and advancements in financial technology, with Indian businesses playing a prominent role in shaping the future of global fintech.