India, with a population of more than 139 crores, caters to an average of only 27 percent people who are financially literate. This came to the fore after a survey was conducted by a combined effort of India’s financial sector regulators i.e., RBI, SEBI, IRDA, and PFRDA through National Centre for Financial Education (NCFE). With such a small number of people who are financially educated, it becomes a major concern for a country like India which is dominated by the marginalized sections.

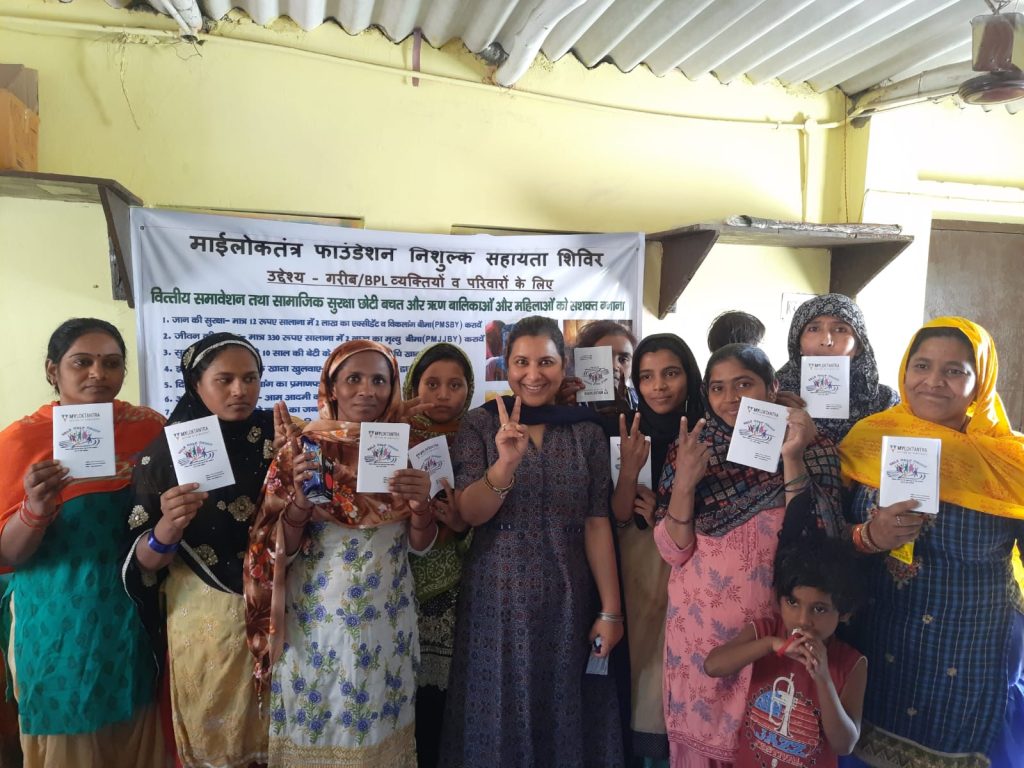

Apart from the government, which is providing financial security to people through various schemes, an Indian Revenue Service officer in Ghaziabad, Smita Singh, is taking proactive steps to secure the finances of the excluded sections and make them aware of the Government schemes and insurances which could benefit them. Speaking to Indian Masterminds, the officer said that women form the core agenda of this project and are the main point of focus behind any strategy.

LOSS DURING COVID 19

The initiative kicked off at a time when the country was dealing with the first wave of Covid 19. Speaking about the initiative, Ms. Smita Singh said, “During the first stage of Covid, we saw a lot of damage to life. Even in our offices, some of the contractual employees like drivers, security guards, data and key operators suffered during the tough time. Among them, I saw a couple of instances where the sole member of the family died, and we were unable to do anything as there was no social security attached to that person.”

This is when the officer with support from her mother’s non-profit organization, Myloktantra Foundation, and other stakeholders started the financial literacy initiative in both Noida and Ghaziabad.

PROVIDING FINANCIAL SECURITY

Ms. Singh said, “Within Pradhan Mantri Jan Dhan Yojana, which came up in the year 2014, the government has devised some tools where pensions, life & accidental insurances are being provided at a very affordable price. However, people are unaware about such schemes and even if they are aware, they don’t know the procedure to sign up in it.”

The team first reaches out to the people in villages and excluded areas and conducts a survey to understand the current situation of a family. Things like necessary documents like Aadhar card etc and bank account are checked. After conducting the survey, camps for Aadhar, PAN, birth certificate, postal services are set up at the village level.

During this process, the team members and volunteers not only explain to the people the way to become a beneficiary in the schemes but also help them to fill up the forms and coordinate with the nearby banks, post office and CSPs for extending the benefits. Sometimes the team also gives financial help to the more needy to become a beneficiary. Their aim is to benefit the most vulnerable sections of the society like daily wage laborers, domestic maids, rickshaw pullers, domestic helpers of the unorganized sector by acquainting them with the provisions of economic security of the government.

BRINGING PEOPLE OUT FROM THE DARK

Within a year, the organization has organized 58 camps in various villages of Noida and Ghaziabad in which around 15,000 people have been provided financial literacy. People were made aware of small savings, Sukanya scheme, life and accidental insurance, pension, etc. Around 5,000 people have benefitted from these schemes and are also been provided with basic identity markers like Aadhaar, birth certificates, pan, etc.

However, this was not solely done by the Myloktantra foundation but was a result of combined efforts from NGO partners and interns from deemed universities like Amity and Gautam Buddhanagar University.

This project is an extra effort shown by Ms. Smita Singh, who along with her duties as an IRS officer, is also bringing back light in the lives of these marginalized sections – the lower income group and especially the women.