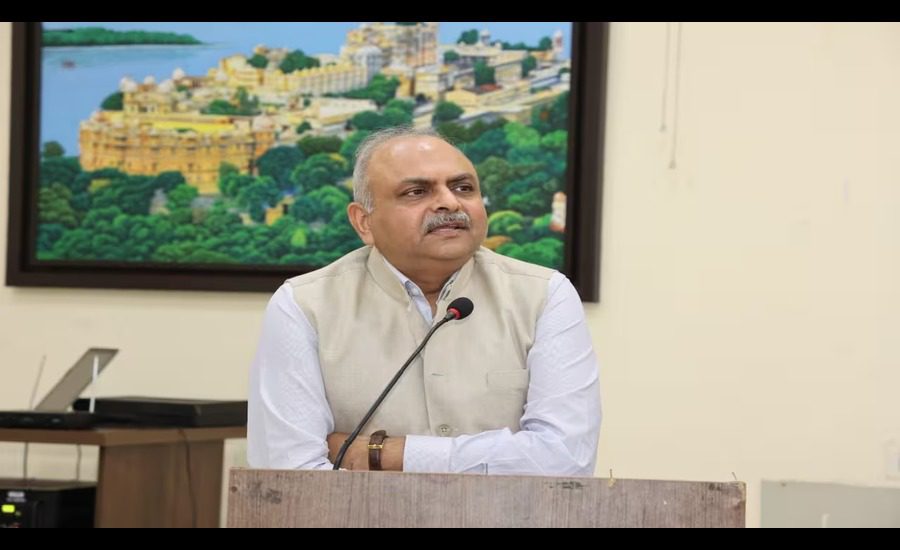

New Delhi — In a strategic move to ensure continuity in leadership and reform momentum, the Appointments Committee of the Cabinet (ACC) has reappointed Ravi Agrawal as the Chairman of the Central Board of Direct Taxes (CBDT) – India’s apex direct tax policy-making body – for one year on a contract basis, effective from July 1, 2025, to June 30, 2026, or until further orders.

Mr Agrawal, a 1988-batch Indian Revenue Service (IRS-IT) officer, has been lauded for his proactive role in streamlining tax administration and strengthening India’s tax base through technological integration and taxpayer-focused policies.

A Proven Leader in Tax Administration

Mr Agrawal took charge as CBDT Chairman in June 2024, succeeding Nitin Gupta (1986 batch IRS officer). Before his elevation, Mr Agrawal served as Member (Administration) in the CBDT since July 2023, overseeing crucial domains including HR, departmental coordination, and policy execution.

Over his career spanning more than 30 years, Mr Agrawal has held several leadership roles, with expertise in digital tax governance, risk-based assessment, and enhancing voluntary tax compliance. His tenure has seen a significant shift toward transparency and simplification of tax procedures – a core vision aligned with the Finance Ministry’s fiscal goals.

Key Reforms Under His Tenure

- Digital Tax Monitoring: Expanded use of data analytics, AI, and automation in return scrutiny and risk management.

- Taxpayer-Centric Reforms: Introduced initiatives for faster refunds, improved grievance redressal, and faceless appeals.

- HR Modernization: Strengthened cadre management and skill enhancement within the Income Tax Department.

- Litigation Management: Focused on reducing pendency and resolving disputes through settlement mechanisms.

His reappointment reflects the government’s trust in his capability to further stabilize the tax system, especially in a year that may involve significant policy measures ahead of Budget 2026.

Government Notification

According to the official notification, IRS Agrawal’s reappointment comes with standard service conditions applicable to re-employed Central Government officers. This ensures continuity in the leadership of one of India’s most critical financial institutions.

A Leadership Steeped in Experience

Known for his calm, reform-driven approach, Mr Agrawal has emerged as a pivotal figure in India’s journey toward modern and transparent tax administration. With global economies witnessing shifts in taxation dynamics, Agrawal’s second term is expected to focus on:

- Expanding cross-border tax compliance frameworks

- Boosting domestic revenue mobilization

- Integrating blockchain and GenAI-based tools in tax operations

- Ensuring ease of tax payment for MSMEs and individuals

About CBDT

The Central Board of Direct Taxes functions under the Department of Revenue, Ministry of Finance. It formulates policies related to direct taxes and supervises the Income Tax Department. The Chairman of CBDT holds the rank of Secretary to the Government of India and plays a pivotal role in tax reforms, revenue mobilization, and compliance enforcement.

Read Also: Leadership Shake-Up at CBDT: Chairman and Two Members to Retire by 2025; Key Appointments Ahead