New Delhi: In a historic move towards tax simplification and citizen-centric reforms, the 56th GST Council Meeting, chaired by Union Finance Minister Nirmala Sitharaman, concluded with major decisions that will significantly reshape India’s tax structure. The council has reduced the existing four GST slabs to two primary ones – 5% and 18%, while creating a separate 40% slab for luxury and harmful goods.

These sweeping reforms, which come into effect from September 22, 2025, aim to ease tax compliance, reduce the burden on consumers, and boost consumption across key sectors.

Key Highlights of the GST Council Meeting 2025

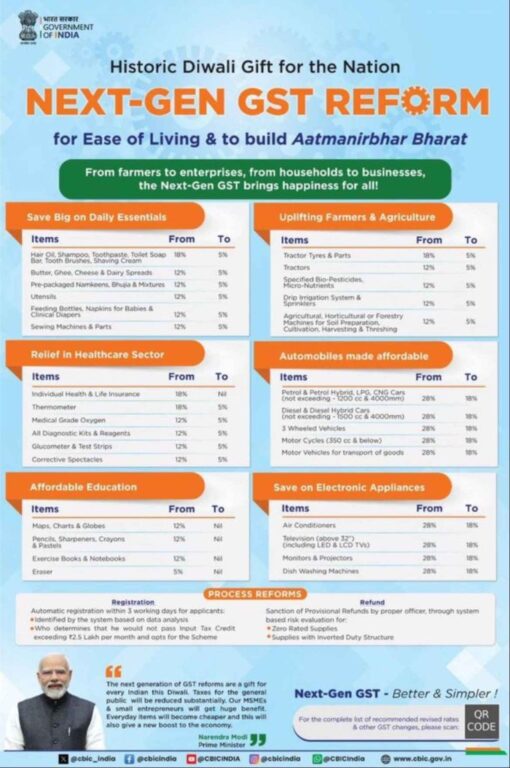

- Existing 12% and 28% GST slabs abolished.

- Essential commodities and daily-use items shifted to 5% or 0% slab.

- 40% GST reserved for luxury and harmful products like tobacco, pan masala, and flavored beverages.

- Many life-saving drugs completely exempted from GST.

GST revisions expected to cause ₹93,000 crore revenue loss, but ₹45,000 crore additional revenue expected from the 40% slab.

What Got Cheaper – GST Reduced to 5% or Zero

Everyday Essentials (Reduced to 5%)

- Toiletries: Shampoo, hair oil, toothpaste, shaving cream, toilet soap bar, toothbrush.

- Food Items: Namkeen, noodles, pasta, coffee, bhujia mixtures.

- Packaged dairy: Butter, ghee, cheese, paneer.

- Household: Utensils, baby bottles, diapers, napkins.

- Footwear: Shoes priced up to ₹2,500 will now attract just 5% GST (up from ₹1,000 earlier).

- Kitchen appliances: Pressure cookers, stoves (non-electric), mixer-grinders.

Healthcare Sector

- Life and health insurance: GST reduced from 18% to 0%.

- Medical equipment: Thermometers, glucometers, test strips, oxygen cylinders – now at 5%.

- 33 life-saving drugs (including 3 for cancer) excluded from GST.

Education & Agriculture

- Books, pencils, erasers, maps, globes – GST 0%.

- Tractors and parts – GST reduced to 5%.

- Micro-nutrients, bio-pesticides, irrigation systems – GST cut from 12% to 5%.

18% GST Slab: Standard Goods

- Automobiles: Cars and bikes (earlier at 28%).

- Cement.

- TV sets (reduced from 28%).

40% GST: For Luxury & Harmful Items

- A special 40% GST slab has been carved out for:

- Pan masala, gutkha, cigarettes, bidis, flavored tobacco.

- Flavored carbonated drinks (soft drinks).

- Other luxury goods (non-essential and harmful).

These rates will remain unchanged until the full recovery of loans and interest under the Compensation Cess Fund is completed.

When Will the New GST Rates Be Implemented?

All new GST slab revisions will be applicable from September 22, 2025 – for both goods and services (except tobacco products which retain current cess levels).

Leaders Speak on GST Reform

Rajesh Dharmani, Himachal Pradesh Minister

“Unanimously, everyone agreed on rationalising the GST rates. This is a reform in the spirit of ‘One Nation, One Tax’. We now effectively have only two slabs, with one special slab for harmful products.”

Harpal Singh Cheema, Punjab Minister

“We proposed an increase in compensation cess, but it wasn’t accepted. However, the rationalization was a much-needed step.”

Manjinder Singh Sirsa, Delhi Minister

“This reform will directly benefit small industries and the common man. Delhi is also planning schemes to regularize unauthorized industrial areas and improve infrastructure.”

What This Means for You

From September 22, expect a price drop in–

- Food & kitchen essentials

- Toiletries & personal care products

- Insurance premiums

- School supplies

- Medicines

- Shoes and clothing

Consumers can expect relief from inflation, while businesses will benefit from simplified compliance.

Government Revenue Impact

- Estimated loss of ₹93,000 crore due to tax cuts.

- Expected gain of ₹45,000 crore from luxury/harmful goods tax at 40%.

- Discussions are ongoing about compensating states for the potential revenue shortfall.