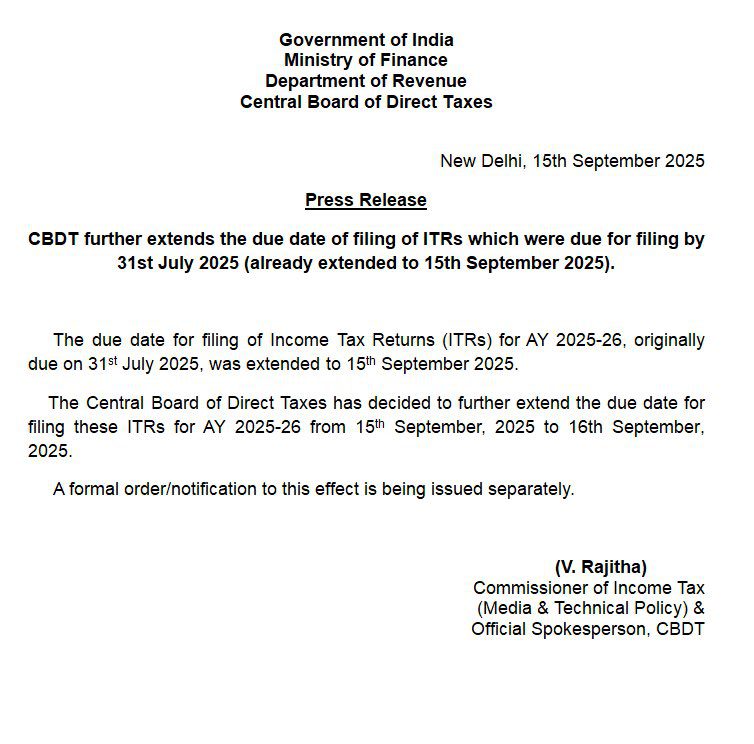

New Delhi: The Central Board of Direct Taxes (CBDT) has extended the due date for filing Income Tax Returns (ITRs) for Assessment Year 2025–26 by one day — from September 15 to September 16, 2025 — following an unprecedented surge in return filings and widespread reports of portal access issues.

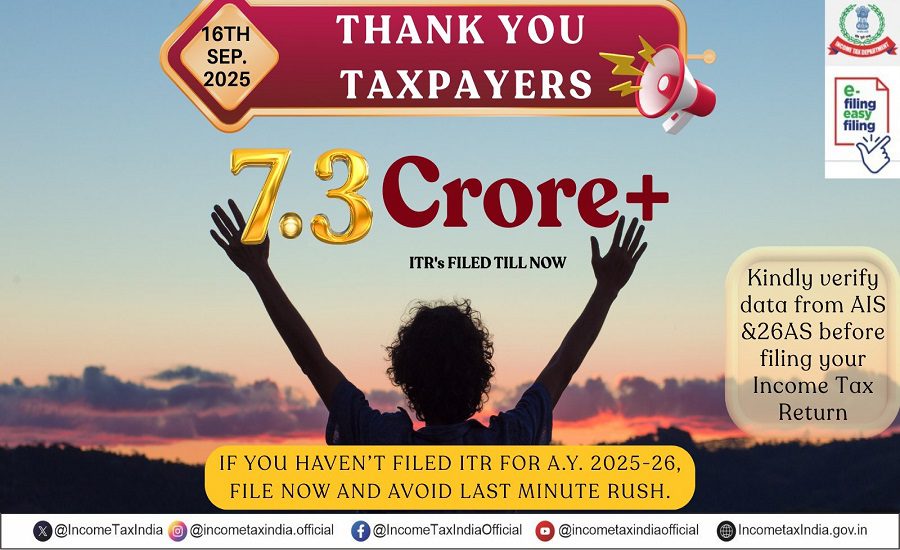

As of late September 15, the number of ITRs filed crossed a record 7.3 crore, surpassing last year’s total of 7.28 crore. The surge led to massive last-minute traffic on the income tax e-filing portal, with many taxpayers encountering technical issues while uploading returns or making payments.

Original Due Date Was July 31, Then Shifted to September 15

Initially, the deadline for filing ITRs for Financial Year 2024–25 (AY 2025–26) was July 31, 2025. However, the date was earlier extended to September 15, due to delays in ITR form revisions and the need for backend system changes in April–May.

As the September 15 cut-off approached, the e-filing portal faced performance bottlenecks, prompting the CBDT to intervene with a last-minute one-day extension.

System Maintenance and CBDT Statement

To accommodate utility changes and system load, the Income Tax Department conducted portal maintenance between 12:00 AM and 2:30 AM on September 16.

In a post on social media platform X (formerly Twitter) shortly after midnight, the department announced:

“Over 7.3 crore returns have been filed by 15 September, 2025 — highest ever. We sincerely thank taxpayers & professionals for their timely compliance.”

The department had been issuing frequent reminders urging users not to delay. On the evening of September 15, it posted:

“More than 7 crore ITRs have been filed so far and still counting!”

Taxpayers Report Glitches; Department Offers Clarifications

Many taxpayers took to social media during the final filing hours to complain about errors while uploading returns or making advance tax payments. In response, the IT department clarified that several of these problems were linked to local device/browser issues, not a system-wide failure.

Users were advised to:

- Clear browser cache

- Use updated browsers

- Try incognito/private browsing mode

Step-by-step troubleshooting guides were also made available on the portal and social platforms.

Late Filers Face Penalties After 16 September

While the one-day extension has given relief to many, those still unable to file by September 16 can submit a belated return until December 31, 2025. However, this comes with late filing fees under Section 234F:

- ₹1,000 for income up to ₹5 lakh

- ₹5,000 for income above ₹5 lakh

Late filers also face interest liabilities under Sections 234A, 234B, and 234C if tax dues remain unpaid. Moreover, delayed filings disqualify taxpayers from carrying forward certain losses.

Read also: Digital India Push: CSC Achieves ₹3,000 Crore Loan Milestone, Empowers 70,000 Borrowers