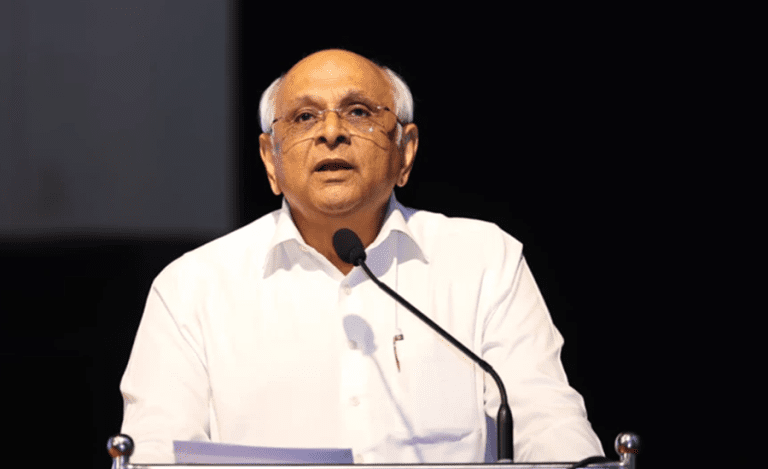

Mumbai: At the prestigious FIBAC Annual Banking Conference 2025, organized jointly by FICCI and the Indian Banks’ Association (IBA), Mr. Shaji K. V., Chairman of NABARD, outlined a forward-thinking strategy to strengthen India’s rural financial landscape through enhanced cyber resilience, climate action, and digital inclusion.

Speaking during a panel session titled “Charting New Frontiers”, Mr. Shaji detailed how NABARD is transforming emerging threats—such as cyberattacks and climate risks—into opportunities for innovation and systemic improvement in the rural economy.

Cyber Resilience for Rural Financial Institutions

In his address, Mr. Shaji emphasized NABARD’s proactive stance in securing the rural banking infrastructure. Key initiatives include:

- Implementation of a Zero-Trust Architecture to reinforce security layers and reduce vulnerabilities.

- Establishment of a Cyber Forensic Lab for detecting and investigating cyber threats.

- Introduction of cyber insurance coverage for Rural Cooperative Banks and Regional Rural Banks, to ensure financial protection from cyber risks.

Commitment to Climate Action and Sustainability

Highlighting NABARD’s role as a catalyst for climate resilience, the Chairman noted that the institution is currently supporting over 40 climate action projects. He also introduced:

- A Climate Risk Disclosure and Management Policy to enhance transparency and preparedness.

- Development of a green taxonomy to guide sustainable investments and projects across rural India.

These initiatives, Mr. Shaji noted, are part of NABARD’s broader strategy to help rural economies adapt to and mitigate the effects of climate change.

Driving Digital Inclusion in Rural Finance

Mr. Shaji also spotlighted NABARD’s significant efforts in digitizing the rural financial ecosystem, including:

- Expansion of Core Banking Solutions in rural institutions.

- Promotion of digital value chain finance to support agriculture and allied sectors.

- Pilot testing of Central Bank Digital Currency (CBDC)-enabled loans to streamline credit access for farmers and small borrowers.

These digital advancements, he said, are turning long-standing access issues into new opportunities for rural communities.

A Vision for an Inclusive Rural Future

Mr. Shaji concluded his address by reinforcing NABARD’s commitment to building a resilient, sustainable, and inclusive rural economy. By integrating cybersecurity frameworks, climate-smart policies, and digital tools, NABARD is positioning itself at the forefront of transforming rural finance in India.

The FIBAC 2025 conference continues to serve as a premier platform for global banking and finance leaders to collaborate on innovation and policy, with NABARD’s strategic vision offering a blueprint for future-ready rural development.

About NABARD

The National Bank for Agriculture and Rural Development (NABARD), established in 1982, is India’s premier development financial institution focusing on agriculture and rural development. Headquartered in Mumbai, NABARD provides credit support, policy guidance, and innovative financing solutions to enhance rural infrastructure, promote sustainable livelihoods, and strengthen India’s agrarian economy.