Mr. Pradeep Kumar Goel, a 2015-batch IRS-C&IT officer, has been appointed as Technical Member (Centre) in the State Benches of the Goods and Services Tax Appellate Tribunal (GSTAT). His appointment adds further strength to India’s tax governance and will enhance uniformity in dispute resolution under the Goods and Services Tax framework.

About the GST Appellate Tribunal

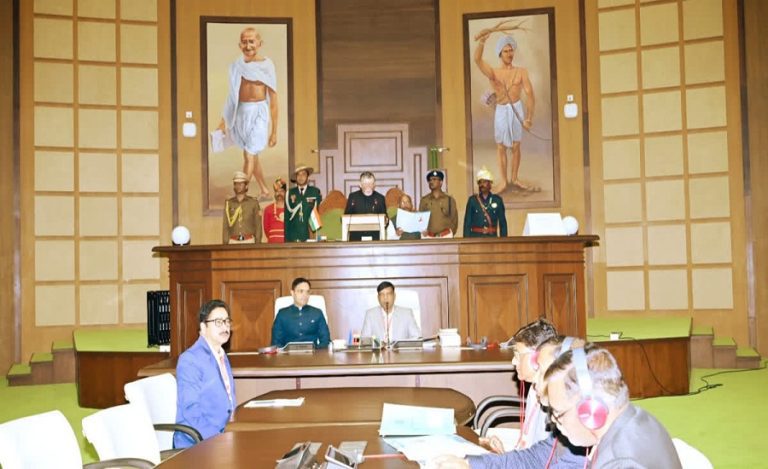

The GSTAT, a specialized quasi-judicial body constituted under the Goods and Services Tax (GST) Act, 2017, plays a pivotal role in ensuring a structured resolution of tax disputes. It functions as the second appellate authority, handling appeals against the rulings of the First Appellate Authority or the Revisional Authority.

With its Principal Bench in New Delhi and multiple state benches across the country, the tribunal ensures consistency in interpretation of GST laws. Its rulings are binding on lower authorities, reducing litigation and creating a more predictable tax environment.

Significance of GSTAT for Governance and Businesses

The GSTAT consists of judicial as well as technical members who bring expertise in tax law, administration, and adjudication. It enjoys the powers of a civil court, including the authority to summon witnesses, call for documents, and enforce its orders. Appeals against GSTAT decisions can be made only in the High Courts and that too on substantial questions of law, ensuring judicial efficiency.

By offering an independent and specialized platform for GST disputes, the tribunal reduces the burden on higher courts and fosters a transparent, business-friendly environment. The appointment of senior officers like Mr. Goel further strengthens the tribunal’s role in upholding taxpayer confidence and supporting India’s indirect tax framework.