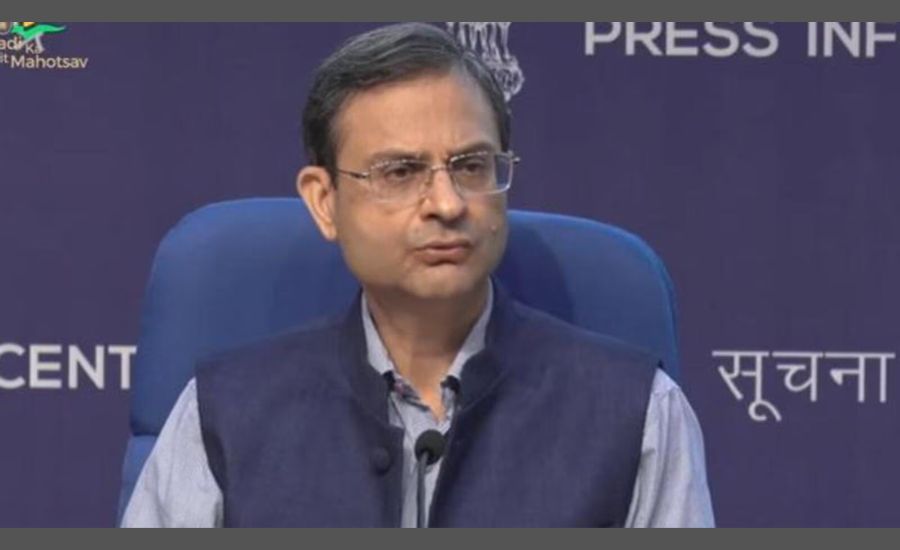

The Reserve Bank of India (RBI) has revised its inflation forecast for the financial year 2025–26 (FY26) downward to 3.7%, from the earlier projection of 4%. Announcing the decision, RBI Governor Mr. Sanjay Malhotra (1990-batch IAS officer) said on Friday that easing food prices and cooling core inflation were the key reasons behind the improved outlook.

Also Read: PM Modi’s 11 Years in Office: A Transformative Journey with Bold Strides in the Energy Sector

Addressing the media after the Monetary Policy Committee (MPC) meeting, Mr. Malhotra stated, “While food inflation remains soft, core inflation is also expected to cool further going forward.” He emphasised that the Indian economy continues to demonstrate strength, stability, and vast opportunities.

In a significant monetary policy move, the MPC cut the benchmark repo rate by 50 basis points to 5.5%, marking its third consecutive rate cut since February 2025. This brings the repo rate to its lowest level in three years, last recorded at this level in August 2022. The RBI has now reduced the repo rate by a total of 100 basis points in 2025.

The central bank also shifted its monetary policy stance from “accommodative” to “neutral,” indicating a more balanced and cautious approach going forward. Mr. Malhotra, however, noted that the space for further rate reductions is now limited after the recent aggressive easing.

Despite a slowdown — with India’s GDP growth falling to a four-year low of 6.5% in FY25 — the RBI has maintained its real GDP growth forecast for FY26 at 6.5%, with quarterly growth projected at 6.5% in Q1, 6.7% in Q2, 6.6% in Q3, and 6.4% in Q4.

On the investment front, Mr. Malhotra highlighted that India continues to remain an attractive destination, with gross FDI inflows rising by 14% to USD 81 billion in FY25. However, net FDI inflows dropped to USD 0.4 billion, primarily due to increased repatriation and outbound investment. He termed this trend as a sign of market maturity, where foreign investors can freely enter and exit.

Foreign portfolio investment (FPI) declined to USD 1.7 billion in FY25 as foreign investors booked profits in equities.

The current account deficit (CAD) for FY25 is expected to stay low, supported by robust services exports, remittances, and a moderated trade deficit. As of May 30, 2025, India’s foreign exchange reserves stood at USD 691.5 billion, enough to cover over 11 months of goods imports and nearly 96% of external debt.

Despite global economic uncertainties, Mr. Malhotra said that India’s external sector remains resilient, backed by improving vulnerability indicators and sustained investor confidence.