What is the best financial advice during the ongoing Corona pandemic? Obviously, go get adequate health insurance. Because it allows you to avail of the best medical facilities without costing a bomb. Insurance premiums may range from Rs 2000 to 200000 per annum depending upon the age, insured amount, and health condition of the insured person. The rich can afford it and with some difficulty, even the middle class manages to get himself medically insured. But what about the poor? They have to shell out up to 80 percent of their income if someone in the family falls ill.

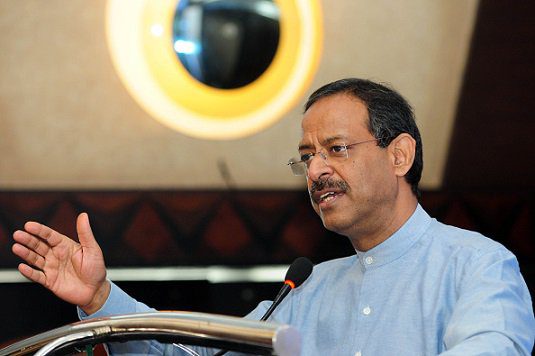

It was with this vision that then Prime Minister Dr Manmohan Singh in 2006 envisaged a Health insurance scheme for the poor. Despite having image of a liberal economist, he was aware that the poor needed government help in the field of medical and health where they often had to spend so much that they had to make so much out of pocket expense that invariably had to take loans.

It was because of this vision that he envisaged Rashtriya Swasthya Bima Yojana, ensuring each below poverty line (BPL) family for Rs 30,000 annually. This scheme was a precursor to the much touted Ayushman Bharat Yojana, providing the poor with an annual health insurance of Rs 5 lakh.

‘If a society can not help the many they are poor, it can not save the few that are rich’

JOHN F KENNEDY

This scheme would have covered each and every person living below poverty line. He entrusted Union Labour Ministry to device ways and means to carry out world’s biggest Health insurance scheme for the unorganised sector because both Rural Development and Health Ministries had earlier failed to deliver on such projects. And the point person in the Ministry of Labour was its then Joint Secretary Anil Swarup.

His first task was to study various available models of health insurance and come up with new model which would have been all-encompassing and suited to India’s needs. Most government schemes entailed huge expenditure and sustained efforts. Many such schemes were devised, launched and executed but died midway due to lack of interest efforts by everyone involved.

The idea was great but the trick was how to make it happen. And, this was real challenge. Fortunately, International Labour Organization (ILO) and World Bank had some experts to help me find answers and evolve a draft. There was reluctance on the part of a number of Central Ministries to associate themselves with the scheme. However, the expertise of ILO and the Bank came in handy and a conceptual framework was evolved.

One such scheme was universal Health Insurance launch by then Prime Minister Atal Bihari Vajpayee in 2003. This could have been a game-changer like MGNREGA proved itself during 2009 elections, but like most government schemes it could not be sustained and died a slow and painful death.

Soon after the task was handed over to Anil Swarup attended a conference organised by International Labour Organisation (ILO) at its country office in Delhi to discuss the annual approach. In his own words, the weather was pleasant in the month of February. However, the tenor of the discussion was the same as any other government meeting. The speeches were mechanically delivered, presentations made, and a general roadmap laid out. Ironically, there was neither discussion on the roads travelled the previous year nor evaluation of the distance travelled. No one seemed too keen to find concrete deliverables.

The discussions were about to come to a close without any new ideas or new conclusions. It seemed to be a waste of time. Just when the meeting was about to conclude, a suggestion was floated to set up a task force to examine various aspects of implementing health insurance in the country for the poor. This task force would include experts from the World Bank, International Labour Organisation and the related ministries.

‘No matter how good any idea is, it has no value unless other people understand it, embrace it as their own and help you implement it’

N.R. NARAYANMURTHY IN ‘THE WRITING ON THE WALL’

This suggestion came out of the blue and one could discern scepticism around the table. However, what perhaps clinched the issue was the fact that the Prime Minister himself had hinted that immediate thought should be given to health insurance. In any case, there was no harm in setting up such a task force, little did they know that this was to lay the foundation for one of the most farsighted schemes. This scheme came to be known as the Rashtriya Swasthya Bima Yojana (RSBY).

WHY RSBY

Health care in India was financed through various sources — individual out-of-pocket payments, central and state government tax revenues, external aid and profits of private companies etc. National Health Accounts data of 2004-05 showed that central, state and local governments together accounted for only about 20% the total health expenditure in India. More than 78% of the health expenditure comprised un-pooled, out-of-pocket expenditures, one of the highest in the world. External aid to the health sector accounted for negligible 2% of the total health expenditure. The Government of India recognised inequities in its health care delivery and financing infrastructure and introduced various measures to overcome it. One of these measures was to increase the budgetary allocations for health care. The Government target was to increase its spending on health care from the 1.1% of GDP to 3% of GDP.

CHALLENGES

First challenge was to ascertain database of the beneficiaries. This had to be sourced from state governments. Many states did not have verified data of people living below the poverty line. The second challenge was to decide whether it had to be run through to existing government hospitals for to enlist services of private hospitals as well. Third factor was to decide whether it has to be a Government-funded scheme or the beneficiaries needed to contribute the insurance premium, full or in parts.

‘Social welfare spending not only reduces inequities and uncertainties within a rich society but also bolsters the confidence and trust within the society to be more generous’

JEFFERY SACHS IN ‘COMMONWEALTH’

Fourth challenge was to convince everybody in Union Government especially the mandarins in the Finance ministry about viability of the scheme. Especially since everybody was highly skeptical of the idea because of failures of many such schemes in the past.

Fifth challenge was to create an IT backbone to handle such massive data – 30 crore insured persons. The system should be robust two functions of seamlessly 24 hours a day for years.

Sixth challenge was to eliminate possibilities of corruption which invariably sleeps in any government scheme handling massive funds. Swarup thus zeroed in on having an absolutely cashless syste

Seventh challenge was to bring insurance companies on board which were sceptical of serving a humongous population without glitches. They had never done this before and those were afraid to tu to move into an uncharted territory. Another decision to be taken was to whether allow only public sector insurance agencies or from private sector as well.

And last but not the least was to convince state governments – both political and the executive – of efficacy off the scheme.

THE SCHEME

After deliberations for many days stretching into late nights, Swarup’s team decided to roll out the scheme through a smart chip card which would have all details of the beneficiaries family. The card will be issued by the insurance company to the people in the database provided to them by the government. Insurance companies including those from the private sector – to promote competition – were supposed to bid for the contract and the lowest bidder would get the job. The government would pay premium amount for each person which often was in the range of Rs 600 to 1000 for a family of five. And the beneficiary was to pay Rs 30 to cover the cost of smart card.

The government would empanel as many private hospitals as possible. They would be given a rate list of treatments and procedures which was up to 40% cheaper than their normal rates. The hospitals readily agreed looking at enormity of possible income through wholesale business potential.

The entire process had to be cashless. Patient armed with RSBY smart card will move into an empanelled hospital. The hospital would inform the insurance agency for approval, to eliminate possibilities of fake billing. After treating and discharging the patient, the hospital would send the bill to the insurance company which will transfer the amount in the hospitals account. In the entire process no cash was supposed to be transacted at any place except the hospital handing over Rs 100/- to the patient to cover his travel cost.

DATABASE

BPL database or the lack of it was exasperating. It was indeed a miracle that many schemes were riding on a database which was non-existent, erroneous, incomplete and, on occasions, incomprehensible. There were two sets of issues. One was data related and the other one technology related. On the data front, the situation was appalling in some states. The worst-case scenario was the incomplete data. This meant a fresh survey, which was a time-consuming exercise. In a number of states, the data did exist, but it was not digitised. The implication was that this data had to be entered in the computer system, and for this; purpose teams had to be set up. Then there was the next stage, where the data did exist in the digital format but not in the desired format. Reformatting required technical capability and all states did not have this capability. These capabilities had to be developed.

Considering the time and effort required, a number of officers just gave up. The states had never looked at the BPL data in such details as was required of them under RSBY. There were several issues relating to the data size, census codes, data presentation (alpha, numeric or a combination of two), the primary relationship and the like. This slowed the process of roll out.

The RSBY could not have taken a call on the veracity of the BPL data. It was assumed that the state was correct though this was not always true.

However, internal inconsistencies were taken care of through validation software that was prepared by the World Bank. Attempts were also made to collect written representations from those that were left out of the list. The insurance company was not authorised to make any corrections on the spot. Their mandate was to roll out the cards based on validated data downloaded from the RSBY website.

UNANSWERED QUESTIONS

Should there be a single framework for the entire country or given the diversity of the country should the states be allowed their own framework?

The concern with allowing the states to have their own platform was if there were diverse frameworks, how would the interoperability issues be addressed? Given the migratory nature of the beneficiaries, portability of benefits and interoperability could not be compromised.

There was a huge debate relating to outdoor patients (OPD). The policy almost came unstuck on this issue as there were strong feelings both in favour and against. The potential moral hazard ultimately clinched the issue against OPD cover. The inclusion or not of pre-existing diseases was debated at length. Maternity benefits had to be initially excluded at the behest of the Ministry of Finance. Wisdom finally dawned and subsequently, maternity benefit was allowed to be included. Contribution by the beneficiaries, especially considering their impoverished status, was a matter of debate as well.

Quite surprisingly, there was a greater opposition from the bureaucracy. What finally won the argument was the ownership issue. It was suggested that the benefit would be valued more by the beneficiaries if some token amount was taken as registration fee annually. It would also help evaluate the scheme later. The scheme was finally proving that if the ‘product’ was good, even the poor were prepared to pay for it.

The next issue in question was the definition of ‘family’ and how many members would get the benefit. The definition had to be changed midway to enable inclusion of parents though the number of beneficiaries was limited to five.

It was difficult to affirm whether it was the right decision to restrict the benefits to only five members when the family size is much larger in several areas. Then, if the family was larger than five, how would the decision regarding exclusion be finalised?

The beneficiary could avail the benefits at any of the network hospitals, both public and private. The role of insurance companies was also a moot point. Should there be one insurance company for each state or should district be taken as a unit? Should multiple insurance companies be allowed to operate in each district to provide a choice to the beneficiary? Would it be practical to do so? Can the beneficiary make such a choice?

Settlement of insurance claims had to be considered upfront to sustain the business interest of the hospitals. Question arose—Could there be an electronic settlement of insurance claims as they were vast in numbers? What data was needed by the Insurance companies to settle these claims? Could it be digitized? With a view to ensuring paperless transactions under the scheme, the decision was to go in for electronic settlement of claims.

There were still issues relating to the software, its maintenance and cost. The insurance companies were obviously allowed to have access to the hard copies in the hospital for random verification. At a conceptual level, it had to be decided whether there should be criteria for empanelling the hospitals. To begin with, a liberal criterion was adopted.

There were indeed complaints about empanelment of hospitals that were grossly ill-equipped and had pathetic sanitary conditions and could hardly be called hospitals. However, there were more puzzling questions related to medical and surgical procedures. Another concern was whether the costs of surgery or other medical procedures should be uniform for the country.

BUSINESS MODEL

Any scheme is not worth the effort if it is not sustained over a period. Most of the government schemes adopt the ‘intensive monitoring model’ of sustenance. Thus, everything is monitored periodically at each level of hierarchy with the lower rung burdened by the presence of the ‘monitors’.

The RSBY sought to address the issue differently. It was perhaps the first ever effort to evolve a ‘business model’ for a social sector scheme. Standardisation of procedures and processes was found essential to ensure interoperability right through the country and also to obviate unnecessary duplication in evolving such procedures and processes.

Thus, documents such as tender, contract, MoU between the centre and the states were standardised, as were medical procedures and the costs thereof. It was a complex exercise involving several contentious issues. This was in the backdrop of World Bank’s inability to produce an acceptable Tender and Contract document for the State of Karnataka. Determining such rates for medical procedures which could be acceptable to the hospitals across the country was also quite a challenge. For a mass scheme where health services are to be bought for large population, the indicative rates fixed were almost 30-40% lower than the prevalent market rates. The rates prescribed were not mandatory and the states were allowed to change them though there were to be uniform rates within the state. However, almost all the states adopted the rates suggested by the Central Government.

Quite interestingly, the hospitals too accepted these rates even though these were well below their usual charges, perhaps this was because now they could fully utilise their bed capacities. There were ideas and suggestions galore during the exercise of standardisation. None of these ideas were tested but such ideas could not be wished away. Each argument had to be settled to the satisfaction of the decision makers.

The standardisation in terms of IT applications was even more complex because even in private health insurance not many IT systems were being used at that time and paper-based identification and claim process was the norm. Technology was key in the rollout of RSBY. The breakthrough came when Rishi Gupta and his team from Financial Inclusion Network and Operations Paytech Limited (FINO) brought before me a Point of Sale (PoS) machine to demonstrate that biometric data could be captured through a mobile gadget. Now it had to be decided which aspects could be standardised by the central Government and which of those could be left to the states. Then, a right balance had to be struck between flexibility to the states and non-negotiable mandatory aspects. Standardisation itself had to be of a nature which could be marketed to the States.

Other central ministries: A game of trust and mistrust

It was indeed ironical that those ministries that had been largely unable to roll out health insurance package in the past attempted to determine the course of RSBY as well. Almost all the government schemes take a long time to roll out because there is an attempt to plug all possible loopholes, apprehending misuse and abuse. The entire system is beset with mistrust. There is paranoia. Hence, nothing moves. The RSBY was different. However, it was an uphill task to make the Central Ministries believe that.

The Finance Ministry still believed that without its stranglehold on each file dealing with funds, all hell would break loose and the system would eventually collapse. Hence, the Finance Ministry insisted on processing every premium payment related file through the internal finance division.

With 600 odd districts in the country and the monthly release of premium based on the number of smart cards issued every month, there would be around 7200 files going up and down the bureaucratic ladder without any value addition. The scheme had evolved differently in all other contexts except this one.

The world around was changing but the Finance Ministry lived in its own world. It still continues to do so. A department of the Ministry of Finance had earlier been assigned the responsibility of implementing the Universal Health Insurance Scheme (UHIS). The scheme was a virtual non-starter. Now, the department had an opportunity to participate in the rollout of the RSBY. They did so initially, but then parted ways as they perceived conflict of interest because public sector insurance companies had also participated in the bidding process. Because of this, the work of Ministry of Civil Aviation and the Ministry of Petroleum would come to a halt as several decisions that they take would affect such companies as these are owned by the government. However, this department was unrelenting. In any case, not many in the government had a clue about how to overrule the diktats of the Ministry of Finance.

The Health Ministry was at a loss. They had ventured in the field of health insurance as a part of National Rural Health Mission (NHRM), but nothing had happened in the first year. As against this, the RSBY was rolling in the first few months of implementation. The Central Health Ministry was nonetheless cooperative in extending all possible aid by way of enabling the use of Rogi Kalyan Samitis at the District level to take part in the RSBY.

Some bureaucrats in the Ministry of Information Technology raised more non-technical issues than technical ones when the scheme was discussed with them. Their logic was simple. As the proposed scheme and the technology had not worked in the past they would not work in the future. It was surprising that innovation was being resisted by those who should have championed it. The RSBY had to evolve independent of this Ministry. The IT revolution in the country had taken a similar path and the rest, as they say, is history.

The Ministry of Rural Development would not part with the BPL data which was critical to the success of the scheme. Quite interestingly, the Ministry did not have the necessary data in the desired format or in the format prescribed by the Ministry itself. The formats had been designed by the Central Ministry long ago, but the states had not quite conformed to it.

However, once the RSBY was set into motion, it generated curiosity about how the backend data management under this scheme would help in data management of MGNREGA, another flagship scheme of the country. The decision of the government to extend the RSBY to such NREGA beneficiaries who had worked for 15 days or more during the previous fiscal year did create a potential synergy between the two flagship schemes of the country. The officers of the Planning Commission were extremely cooperative. Even the presence of hostility at some levels did not make much of a difference. A presentation before Montek Singh Ahluwalia, Deputy Chairman served the purpose. He was quite impressed with the concept and the initial progress under the scheme. His enquiry whether a presentation was made before the Prime Minister, did the trick. The other members, as well as the bureaucracy in the Planning Commission understood the nuances of the scheme. It was the support from such organisations that enabled the smooth rollout of the scheme.

INSURANCE COMPANIES

At the outset, the insurance companies did not believe that such a scheme on such a scale would ever roll out. They were not only unprepared but also unwilling to prepare. Primarily operating in the comfortable confines of urban areas, investing time, effort and money in such an ambitious scheme was not their cup of tea. A series of meetings and a lot of groundwork had to be undertaken to convince the insurance companies that the government meant business and that there was a business for insurance companies in the scheme. Unlike other insurance schemes of the government that involved only public sector insurance companies, with an accompanying mandate from the concerned ministry, the RSBY was a scheme thrown in as a business proposition. Hence, it had to be marketed and sold.

The insurance companies were not technically equipped to handle such a humongous scheme, which needed a considerable amount of technical inputs. Initially, there was a new face in every meeting. Mostly they asked rudimentary questions. While a public sector company executive kept asking about the role of TPAs, some private companies where enterprising enough to develop inhouse facilities.

Courtesy NDTV

Each company appointed National nodal officers who used to have a monthly meeting with the RSBY team. Chairman and Managing Directors (CMDs) also used to have a quarterly meet with the ministry which often helped in mid-course correction.

INTERNATIONAL AGENCIES

Besides World Bank and ILO, a German government agency Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) also helped RSBY materialize. Though the organisation did not have a formal arrangement with Ministry of Labour, hit found value in the scheme and used fund from its ongoing projects with health ministry, I’m pushing RSBY.

Robert Palacios from World Bank, went out of his way to divert some funds available with the Bank and offered its use as Technical Assistance to prepare and test the software for the scheme. It was indeed a daring offer and perhaps no one except Robert would have made such an offer. This money obviated the need for our approaching the Finance Ministry to provide funds. Going by my past experience with the Finance Ministry, it would have been extremely difficult to obtain allocations. This fund from the Bank also provided us with the required flexibility to select an appropriate agency to do our job. Had this not happened Rashtriya Swasthya Bima Yojana (RSBY) would not have materialised. This money was utilised to develop and test the software and also to prove that the ideas that we were developing would work. Had it failed, Robert would have been in serious trouble. His explanation was still called for having diverted the funds but the subsequent success of RSBY helped him get out of a tricky situation.

On this technological platform emerged the first ever cashless, paperless and portable health insurance scheme that came to be recognised the world over. UNDP and UNICEF also helped out RSBY team in ironing out some hurdles.

CROSS-BORDER CEASEFIRE

RSBY had done well in India and though its recognition came pretty late within the country, it was being acclaimed the world over. World Bank had recognised this scheme as a “model of good design and implementation with important lessons for other programmes in India”. United Nations Development Programme (UNDP) and International Labour Organization (ILO) recognised the scheme as one of the top social security schemes in the world. The Bank believed that this scheme could benefit many other countries that were attempting to provide social security to the deprived sections of society.

It was as part of this expedition that Mr Anil Swarup had been invited to a workshop in Bangkok, Thailand. The partners on this occasion were the adversaries in the sub-continent, India and Pakistan. It was like playing a cricket match in a third country as they couldn’t do so in their own countries. The atmosphere in the room was quite relaxed. If there was any tension, it was amongst the members of the Pakistan delegation.

Pakistan, like India, was a federal country with the states having a defined role in the execution of the schemes. Considering the likely impact of the scheme and the political mileage that could be got out of it, the States were now arguing for a greater role whereas the federal government wanted to run the scheme on its own. The details of the scheme were yet to be finalised. In fact, the scheme itself was to find its feet in Pakistan but a debate had already ensued on the roles of the respective governments. It was so typical of the sub-continental psyche. We were anticipating problems even before commencing the journey!

Quite ironically, Mr Anil Swarup, an Indian, had to mediate between the warring Pakistani factions. Mr Swarup had undertaken this tough exercise to get the states on board within India and he used this experience to convince the Pakistani is that both federal Government and States need to corporate and contribute to make the story a success has India had done.

(With Excepts from Mr Anil Swarup’s books ‘Not Just A Civil Servant’ and ‘Ethical Dilemmas of a Civil Servant))