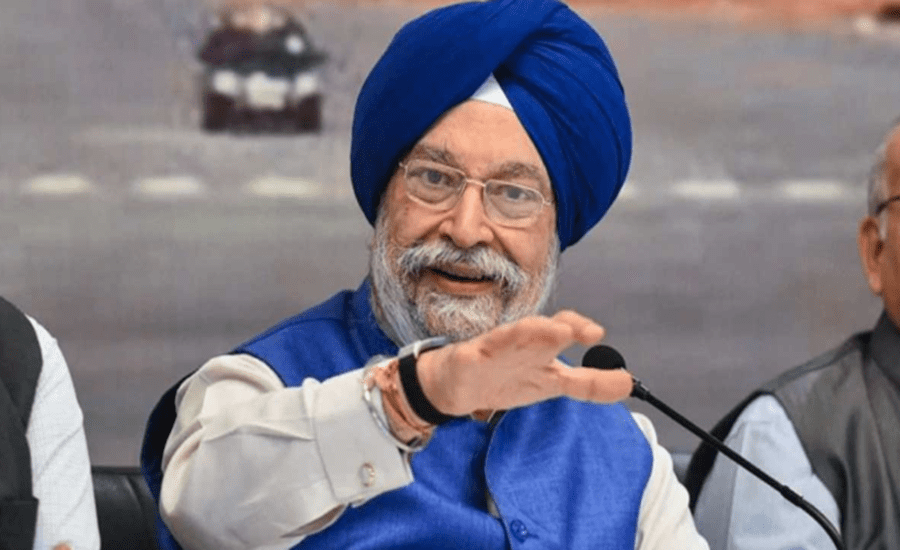

New Delhi: Union Minister for Petroleum and Natural Gas, Hardeep Singh Puri, has voiced strong concerns over the low market valuation of India’s state-owned oil marketing companies (OMCs) despite their robust financial performance. Addressing the media on Friday, Puri underscored the government’s disappointment with the investor community for undervaluing public sector undertakings (PSUs) like Indian Oil Corporation (IOC), Bharat Petroleum Corporation Limited (BPCL), and Hindustan Petroleum Corporation Limited (HPCL).

“The three OMCs have reported combined profits of ₹2.5 lakh crore over the last six years. Yet their market valuation is comparable to Swiggy and Zomato, which together have incurred losses of ₹24,000 crore,” the minister stated, highlighting the glaring discrepancy.

No Full Disinvestment Plan for Oil PSUs

Puri dismissed speculation around the privatisation of BPCL or any other major OMC, making it clear that there is currently no plan to fully divest government ownership in these companies. However, he did suggest that the government may explore partial stake sales in the future to enhance efficiency and attract strategic partnerships.

Read also: PSPB Athletes Shine as Oil & Gas PSUs Strengthen India’s Sporting Ecosystem, Says Hardeep Singh Puri

Investor Bias Against PSUs?

A senior official accompanying the minister hinted at a deeper problem — perceived bias among investors who assume that government control leads to poor returns. The official noted that market players fear the state may compromise profitability to regulate fuel prices — an assumption he called misguided.

Puri countered this notion by highlighting the autonomy enjoyed by oil PSUs, saying, “These are not family-run businesses. Our PSUs follow independent, board-driven decision-making.” He also noted that most government-run companies offer superior dividend payouts compared to private players. “Almost all government PSUs pay dividends regularly, unlike some of the largest private companies,” he pointed out.

Clarification on Refining Margins

Addressing the gap in gross refining margins (GRMs) between PSUs and private refiners like Reliance Industries, Indian Oil Corporation Chairman A. S. Sahney explained that the difference is due to disparate calculation methods. He announced that from the next financial quarter, all public sector OMCs will adopt the same GRM calculation standards as their private counterparts, improving comparability for investors.

LPG Under-Recoveries & Ethanol Concerns

On the issue of under-recoveries in LPG sales, the Minister assured that the government has been compensating the companies adequately and on time. “There has been no delay or protest from the management. Executives have done their job efficiently,” he said.

Responding to questions on the ethanol blending program, Puri termed worries about engine damage or fuel inefficiency as “pure baloney.” He reaffirmed that the government has no plans to exceed the current 20% ethanol blending limit, and added that there is no evidence to suggest it negatively impacts vehicle performance.

Hardeep Singh Puri’s remarks reflect the government’s firm stance on supporting and strengthening public sector oil companies. While pushing back against the narrative that PSUs are inefficient or less profitable, the Minister emphasised their critical role in India’s energy security and their commitment to shareholder value through consistent profitability and dividends.

As the energy sector undergoes rapid transformation, the government appears keen to defend the relevance and performance of its key assets — not just through reforms and investments, but also through narrative correction in the investor community.

About BPCL

Bharat Petroleum Corporation Limited (BPCL), a Maharatna PSU under the Ministry of Petroleum and Natural Gas, is one of India’s leading energy companies. With a diversified portfolio across refining, marketing, petrochemicals, natural gas, and renewables, BPCL continues to pioneer initiatives supporting India’s transition toward sustainable energy and net-zero goals.

Read also: BPCL Kochi Refinery Turns 60, Launches ₹5,044 Cr Expansion Plan, Eyes Net Zero by 2040