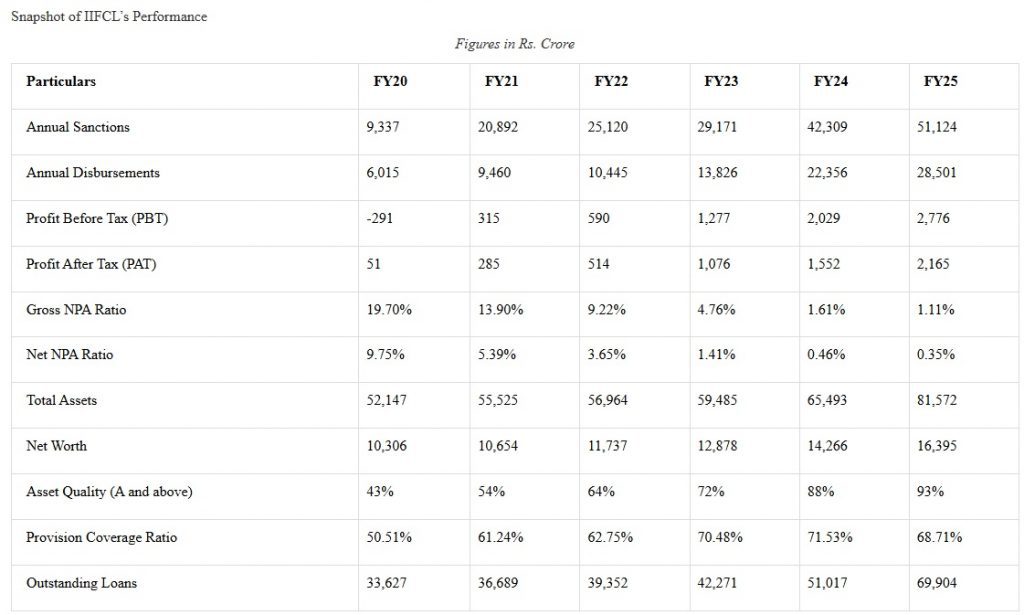

New Delhi: India Infrastructure Finance Company Limited (IIFCL), a premier government-owned financial institution, has reported a fifth consecutive year of record-breaking performance in FY 2024–25, with the highest-ever annual sanctions of ₹51,124 crore and disbursements of ₹28,501 crore, reflecting year-on-year (YoY) growth of 21% and 28% respectively.

In an announcement made by Managing Director Dr. P.R. Jaishankar, the company also disclosed a record profit before tax (PBT) of ₹2,776 crore and profit after tax (PAT) of ₹2,165 crore, representing a 39% growth in PAT over the previous fiscal and an astonishing 42x jump over FY 2019–20 figures.

Key Financial Highlights–

- PBT: ₹2,776 Cr (up ~37% from FY 2023–24)

- PAT: ₹2,165 Cr (up ~39% YoY)

- Net Worth: ₹16,395 Cr (up 15% YoY; 59% growth over FY 2019–20)

- CRAR: 23.44%, well above regulatory requirements

- Gross NPA: Down to 1.11% from 19.7% in FY 2019–20

- Net NPA: Down to 0.35% from 9.75% in FY 2019–20

- Standalone Loan Portfolio: ₹69,904 Cr (up ~37% YoY)

Strengthening Portfolio Quality and Long-Term Investments

The company highlighted a substantial improvement in asset quality, with ~93% of its assets now externally rated ‘A’ and above – a notable rise from ~43% in March 2020. Simultaneously, IIFCL continues to expand its investment in Infrastructure Bonds and InvITs, reaching ₹29,102 Cr and ₹14,220 Cr respectively by the end of FY 2024–25.

Accelerated Infrastructure Financing

With cumulative sanctions and disbursements now at ₹3.06 lakh crore and ₹1.56 lakh crore respectively, over half of these were achieved in the last five years, signaling IIFCL’s increasing role in driving India’s infrastructure development. The consolidated cumulative figures stood at ₹3.53 lakh crore (sanctions) and ₹1.79 lakh crore (disbursements).

IIFCL’s Outlook

Backed by strong capital adequacy and improving asset quality, IIFCL has positioned itself as a key institution in India’s long-term infrastructure financing strategy. Dr. Jaishankar reiterated the company’s commitment to supporting nation-building through responsible and high-quality lending.

About IIFCL

IIFCL is a government-owned financial institution that caters to the long-term financing needs of India’s infrastructure sector. It is amongst the most diversified public sector infrastructure lenders in terms of eligible infrastructure sub-sectors and product offerings. IIFCL is also active in providing policy inputs in infrastructure financing space to the Government through various forums, with an aim to promote and develop world-class infrastructure in India.