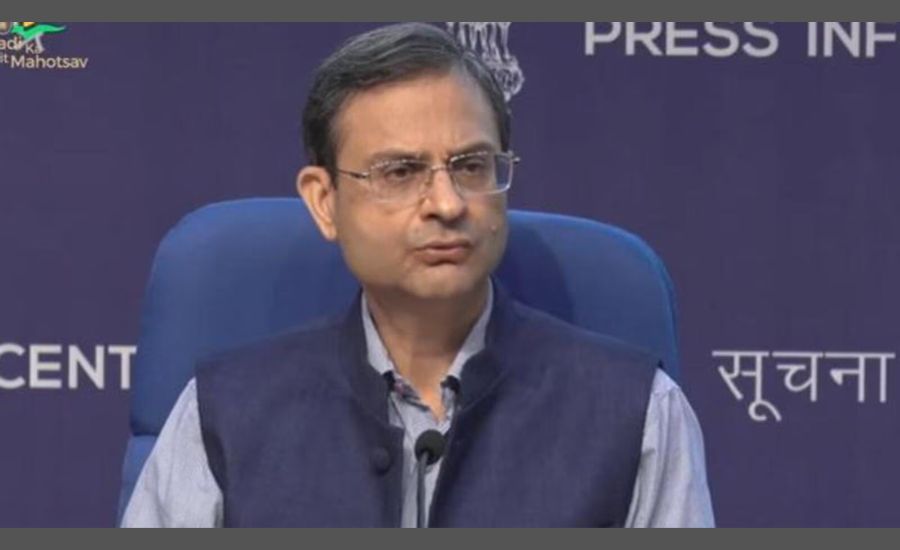

Reserve Bank of India Governor Mr. Sanjay Malhotra (1990-batch IAS officer) reiterated on Friday that the central bank does not target any specific price band for the rupee. His remarks came at a time when the domestic currency briefly breached the 90-mark against the US dollar and continues to hover near that level.

Mr. Malhotra emphasised that the rupee is allowed to find its own correct value, shaped entirely by market forces. He said the forex market in India is deep and efficient, especially over the long term.

Focus on Curbing Only Abnormal Volatility

Responding to questions on rupee depreciation during the post-monetary policy press briefing, Mr. Malhotra noted that fluctuations are a natural part of currency markets. The RBI’s role, he said, is limited to reducing abnormal or excessive volatility, not manipulating value.

He clarified that the central bank does not aim to defend any specific rupee level and remains committed to maintaining orderly market conditions.

USD/INR Swap Is a Liquidity Tool, Not a Defence Mechanism

This month, the RBI announced three-year USD/INR Buy-Sell swaps of USD 5 billion. When asked whether the move was intended to arrest the rupee’s slide, Mr. Malhotra stressed that the exercise was purely a liquidity management measure.

He reaffirmed that the RBI allows the rupee to find its own correct position based on economic fundamentals and market behaviour.

Strong Forex Reserves Provide Stability and Confidence

India’s foreign exchange reserves stood at USD 686.2 billion as of November 28, 2025. This provides an import cover of more than 11 months, offering strong macroeconomic stability.

Mr. Malhotra highlighted that the current account remains manageable. He added that the strength of India’s economic fundamentals should support improved capital inflows in the coming months.

Capital Flows Moderate but Economic Fundamentals Remain Firm

Foreign portfolio investment recorded a net outflow of USD 0.7 billion in 2025–26 so far, driven mainly by persistent equity withdrawals. Flows under external commercial borrowings and non-resident deposit accounts have also moderated compared to last year.

Despite these temporary pressures, the RBI expects stability due to strong reserves and a healthy economic outlook.

Rate Cut Transmission Now the Priority for RBI

Following the recent 25 basis point reduction in the policy repo rate, Mr. Malhotra said the RBI will now focus on ensuring seamless transmission of the rate cut to the real economy. The central bank expects this move to support growth, improve liquidity and strengthen investment activity.

About the Reserve Bank of India (RBI)

The Reserve Bank of India, established in 1935, is the nation’s central bank responsible for regulating the monetary and financial system. It oversees banking regulation, currency issuance, financial stability, and payment systems while formulating policies that support economic growth and price stability. As the apex monetary authority, the RBI plays a pivotal role in shaping India’s financial landscape.

Also Read: Government Confirms FDI Limit in Public Sector Banks to Remain at 20%, No Proposal for Increase