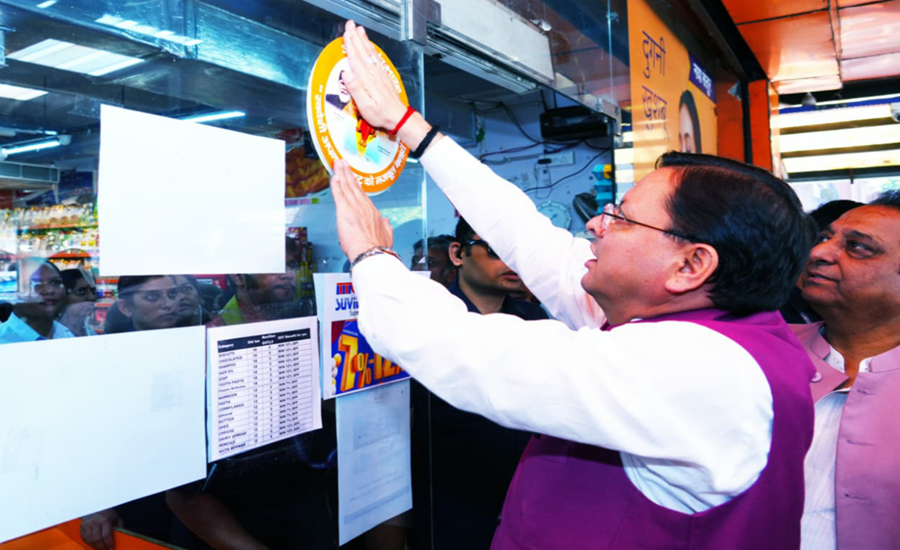

Uttarakhand Chief Minister Mr. Pushkar Singh Dhami participated in an awareness event organized in Patel Nagar, Dehradun, on Friday, as part of the nationwide “GST Bachat Utsav” campaign. The event aimed to spread awareness about the recent reductions in GST rates and their benefits for both consumers and traders.

Speaking to a gathering of local traders and residents, Mr. Dhami highlighted that under Prime Minister Mr. Narendra Modi’s leadership, India has entered a new era of progressive economic reform. He called the GST rate revision a historic step in making everyday goods more affordable and accessible to all sections of society.

Reduced GST Rates to Boost Affordability and Rural Demand

The rationalisation of GST, which took effect on September 22, includes daily-use items, packaged foods, and personal care products now being placed in the 5 percent GST slab, down from 12 to 18 percent previously. According to industry estimates, this move will likely lead to a 4–6 percent reduction in retail prices, especially benefiting rural and lower-income households.

Staple items such as paneer, khakhra, and chapati have been shifted to the zero-tax bracket, significantly easing the cost burden on families.

Festival Season Optimism: A Timely Boost for Trade

Mr. Dhami noted that the GST Bachat Utsav has been strategically launched during the Navratri festival season, with Diwali around the corner, offering timely economic relief and reviving market enthusiasm. Traders echoed this sentiment, calling the initiative a “timely gift” that will benefit both buyers and sellers.

The event fostered direct communication between the government and stakeholders, allowing Mr. Dhami to gather real-time feedback from retailers, small businesses, and citizens on the ground.

Call for Swadeshi Products and Local Economic Strengthening

The Chief Minister also appealed to traders and consumers to prioritise indigenous and locally produced goods. “Supporting Swadeshi is essential not only for the state’s self-reliance but also for contributing to the broader vision of an Aatmanirbhar Bharat,” he stated.

He urged business owners to inform consumers about the reduced GST rates and pass on the benefits transparently. The move is expected to further streamline compliance, eliminate inefficiencies like the inverted duty structure, and make the system more equitable.

Structural Tax Reform for a New India

The GST reforms, as reported by Union Bank of India, are not merely about tax reduction but signify a broader sectoral transformation. With simplified tax slabs, better compliance frameworks, and reduced burden on small traders, the reform is laying the groundwork for stronger rural demand and sustainable consumer-driven growth.

CM Dhami’s Outreach Marks Citizen-Centric Governance

The outreach program in Dehradun underscores the Uttarakhand government’s efforts to align state-level engagement with national policy reforms, focusing on inclusive development, economic affordability, and citizen-centric governance.