New Delhi: In a landmark decision to fortify India’s export economy and empower micro, small, and medium enterprises (MSMEs), the Union Cabinet chaired by Prime Minister Narendra Modi has approved the launch of a Credit Guarantee Scheme for Exporters (CGSE). The scheme is designed to provide 100% credit guarantee coverage for loans up to ₹20,000 crore through the National Credit Guarantee Trustee Company Limited (NCGTC), helping exporters access collateral-free credit and enhance their competitiveness in the global market.

Focus on MSME Exporters and Liquidity Enhancement

The newly approved CGSE seeks to address one of the biggest challenges faced by MSME exporters — limited access to finance due to collateral constraints. By offering full credit guarantees, the scheme will ensure smoother access to working capital, allowing businesses to maintain production cycles, fulfill global orders, and expand into new markets.

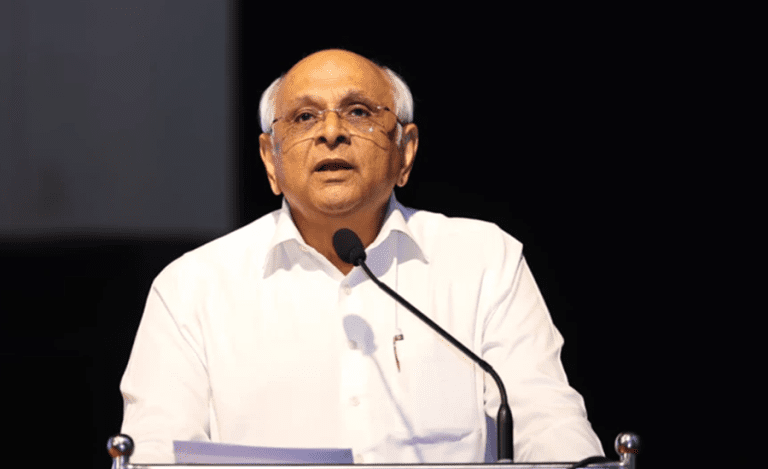

Announcing the Cabinet decision, Union Minister Ashwini Vaishnaw said, “This initiative reflects the government’s deep commitment to supporting India’s MSME exporters. By easing liquidity pressures and offering collateral-free credit, we are enabling them to diversify into high-potential markets and strengthen their role in India’s export growth story.”

He further emphasized that the scheme aligns with the government’s vision of an Aatmanirbhar Bharat, where Indian MSMEs can compete globally while contributing to domestic economic resilience.

Read also: Chhattisgarh Secures ₹33,000 Crore Investment Proposals at Ahmedabad Investor Connect Meet

Implementation and Oversight

The Department of Financial Services (DFS) will oversee the implementation of the CGSE through the NCGTC, with active participation from Member Lending Institutions (MLIs) — including public and private sector banks and key financial institutions.

A Management Committee, headed by the Secretary (DFS), will monitor the scheme’s rollout, address operational challenges, and ensure efficient utilization of the guarantee corpus. The committee will also periodically review outcomes to ensure that the credit support reaches intended beneficiaries effectively.

Catalyst for Export Growth and Employment

According to government estimates, the CGSE is expected to benefit thousands of MSME exporters by unlocking affordable credit and driving export diversification. Enhanced liquidity will not only strengthen existing enterprises but also enable small and emerging businesses to scale up operations and tap into new geographies.

The move is also expected to create substantial employment opportunities, particularly in export-driven sectors such as engineering goods, textiles, chemicals, pharmaceuticals, and renewable energy equipment.

Export Promotion Mission Announced

In a complementary step, the Cabinet also cleared an ambitious ₹25,060-crore Export Promotion Mission to be implemented over the next six years. The mission will provide interest subvention to MSME exporters, thereby reducing borrowing costs and enhancing their financial viability in global markets.

Background: Strengthening India’s Export Ecosystem

Exports contribute nearly 21% to India’s GDP and provide livelihoods to over 45 million people. The MSME sector alone accounts for 45% of total exports, underscoring its central role in India’s trade and economic landscape.

By addressing key financial bottlenecks, the CGSE is expected to accelerate progress toward the government’s target of achieving USD 1 trillion in exports in the coming years. It complements ongoing reforms to improve ease of doing business, enhance logistics efficiency, and expand market access under flagship initiatives such as Make in India and Districts as Export Hubs.

Government’s Commitment to Global Competitiveness

The Cabinet’s decision marks another step toward building a robust and inclusive export financing ecosystem that supports risk-taking, innovation, and long-term growth. By backing MSMEs with financial security and credit access, the government aims to reinforce India’s position as a trusted global export hub while ensuring that small businesses remain at the heart of the nation’s growth momentum.