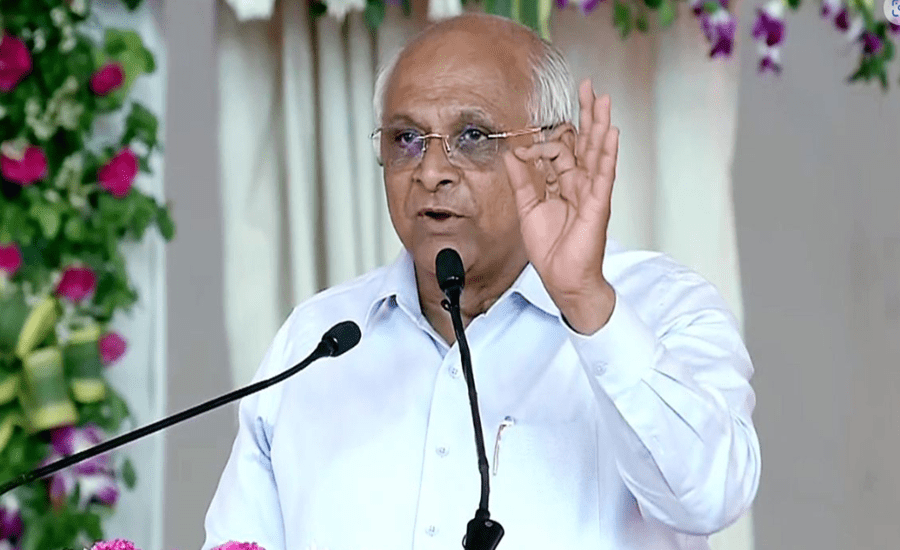

Gandhinagar: Gujarat Chief Minister Mr. Bhupendra Patel has called upon cooperative banks across the state to take a more proactive and supportive role in disbursing loans to Self-Help Groups (SHGs) and Sakhi Mandals, in line with the National Rural Livelihood Mission (NRLM) and Prime Minister Narendra Modi’s vision for rural women’s self-reliance.

Speaking at a high-level review meeting held in Gandhinagar, CM Patel emphasized the critical role of financial institutions in supporting economic activities of rural women, urging cooperative banks to simplify credit processes, organize district-level loan camps, and fast-track disbursals for eligible groups.

Read Also: Gujarat Becomes First State to Lead Cruise Bharat Mission with Dedicated Coastal Circuits

Loan Support Crucial to Fulfill PM Modi’s Vision: CM Patel

Chief Minister Patel stated that cooperative banks must step up their involvement in realizing the central vision of empowering Sakhi Mandals by providing access to timely and adequate credit. “These self-help groups are not just microeconomic units — they are the engines of rural empowerment,” he said. “Supporting them is not only good economics, it is social transformation.”

He added that SHGs have shown high loan repayment discipline, and banks should not fear non-performing assets (NPAs) when supporting these women-led collectives.

State’s Rural SHG Landscape: 2.84 Lakh Groups and Growing

Gujarat currently has 2.84 lakh active rural self-help groups, of which:

- 1.76 lakh are involved in agriculture-based activities

- 16,608 operate in production and trade

- 6,973 engage in other livelihood enterprises

Under the NRLM, these groups are eligible for loans up to ₹20 lakh. The Gujarat Livelihood Promotion Company (GLPC) facilitates these loans in collaboration with both Central and State Government schemes.

₹1,240 Crore Loan Target for FY 2025-26

A presentation at the meeting revealed that ₹1,240 crore in loans has been targeted for 88,200 SHGs during FY 2025–26. So far, 13,000 groups have already been sanctioned loans — an encouraging figure, but CM Patel urged acceleration of the remaining disbursals.

District-Level Loan Camps and Cluster Workshops

To streamline the loan process, CM Patel directed cooperative banks to:

- Organize district-level loan disbursal camps

- Hold cluster-level awareness workshops for rural women

- Provide training and handholding to Sakhi Mandals

- Ensure quick scrutiny and minimal rejection of credit applications

He proposed quarterly review meetings between cooperative bank chairpersons and rural development officials, to be chaired by the Rural Development Minister, for timely monitoring and coordination.

Senior Ministers and Officials Join Hands in the Effort

The meeting saw participation from several senior dignitaries and administrative heads:

- Raghavji Patel, Minister of Rural Development

- Jagdish Vishwakarma, Minister of State for Cooperation

- Kunvarji Halpati, Minister of State for Rural Development

Also present were officials from NABARD, SLBC, and state finance and rural development departments. Mr. Jagdish Vishwakarma encouraged banks to take a mission-mode approach to NRLM implementation, ensuring real-time coordination at the grassroots level.

Read Also: PMFME Empowers Gujarat’s Food Entrepreneurs: Stories of Innovation, Scale and Aatmanirbharta

Empowered Women, Stronger Rural Economy

CM Patel concluded by emphasizing that rural women empowered through credit and entrepreneurship become pillars of financial strength for their families and communities. “They are agents of change, and their economic independence will define Gujarat’s rural transformation in the coming decade,” he said.