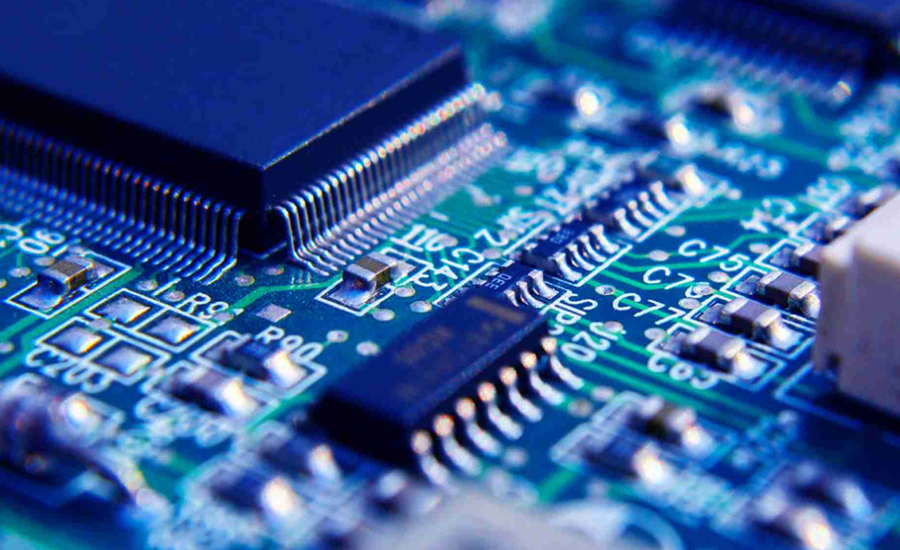

New Delhi: The Indian electronics sector is rapidly evolving from just assembling finished goods to manufacturing upstream components—such as multi-layer PCBs, camera modules and copper-clad laminates—that feed into devices, telecom, EVs and defence.

The Electronics Component Manufacturing Scheme (ECMS) was framed to boost domestic manufacturing of such critical components, increase domestic value‐addition and integrate India into global electronics supply chains.

According to government data, ECMS was aimed at attracting investment of around ₹59,350 crore, producing ₹4.56 lakh crore and creating around 91,600 direct jobs.

With the latest approvals, India is taking a big leap forward in that direction.

Key Highlights of the Approved Projects under ECMS

- The Union Cabinet has approved seven projects under ECMS with a total investment of ₹5,532 crore.

- These projects are projected to yield production worth ₹36,559 crore.

- Over 5,100 direct jobs will be created across these units.

- The units are geographically spread: Tamil Nadu (5 units), Andhra Pradesh (1 unit), Madhya Pradesh (1 unit)—indicating balanced regional growth beyond the traditional hubs.

Targeted segments

- 100% of demand for copper-clad laminate to be met domestically

- 20% of Printed Circuit Boards (PCBs) demand

- 15% of camera modules demand to be localised.

- Around 60% of the production from these units is earmarked for export.

Strategic Significance: What this means for India

1. Reducing import-dependence: By manufacturing critical components domestically—such as copper-clad laminates, PCBs and camera modules—India can gradually reduce reliance on imports and strengthen supply-chain resilience. The approved units signal this shift.

2. High-skill jobs & advanced manufacturing: Creating over 5,100 direct jobs in component manufacturing means more high-skill roles in R&D, precision manufacturing and assembly. This aligns with India’s goal of moving up the value chain rather than only assembling finished goods.

3. Boosting exports and global supply chains: With 60% of production targeted for exports, India is positioning itself as a trusted global manufacturing base for components used in telecom, EVs, renewables and defence.

4. Regional industrial spread: While electronics manufacturing has been concentrated in a few states, this approval spreads manufacturing across Tamil Nadu, Andhra Pradesh and Madhya Pradesh, promoting inclusive industrial growth across regions.

5. Complementing other initiatives: ECMS complements other flagship programmes such as the Production Linked Incentive Scheme (PLI) and the India Semiconductor Mission, thus creating an end-to-end electronics manufacturing ecosystem—from chips to components to finished devices.

Looking Ahead: What to watch for

Roll-out of approved projects: The timeline for units to become operational will be critical—investments turned into production and jobs.

Actual job creation numbers: While 5,100 + direct jobs are projected, tracking actual hires, especially high-skill jobs, will determine impact.

Supply-chain localisation levels: How much of raw material and value-addition can move from imported to domestic source will define success.

Exports milestone: Achieving the targeted 60% production for exports and integration into global value chains will strengthen India’s proposition.

Next batch of approvals: This first batch signals the start; more approvals and higher investment volumes are expected under ECMS over the coming months.

State policy alignment: States where the units are located (Tamil Nadu, Andhra Pradesh, Madhya Pradesh) should roll out enabling policies—land, power, incentives—to ensure smooth implementation.