The Indian Renewable Energy Development Agency Ltd. (IREDA), a premier Non-Banking Financial Company (NBFC) under the Ministry of New & Renewable Energy (MNRE), has reaffirmed its leadership in the clean energy financing space with a strong financial performance in the first quarter of FY 2025–26. The agency reported a 49% year-on-year growth in operating profit and a 30% increase in total income from operations during the period.

Also Read: CSR Milestone: NHPC Marks 50 Years with Tree Plantation Drive in Jammu, Reinforces Green Commitment

IREDA’s loan book grew by 26% to Rs. 79,941 crore, backed by robust lending across solar, wind, green hydrogen, electric vehicles, and smart meters. Its net worth rose by 36% to Rs. 12,402 crore, underscoring sustained investor confidence.

Access to Capital and Global Funding

Maintaining its AAA (Stable) domestic credit rating, IREDA successfully mobilized Rs. 5,903 crore during the quarter, which includes a significant JPY 26 billion External Commercial Borrowing (ECB) raised from SBI Tokyo. This strategic infusion ensures access to cost-effective global capital, further supporting IREDA’s financing capabilities in the fast-expanding renewable energy sector.

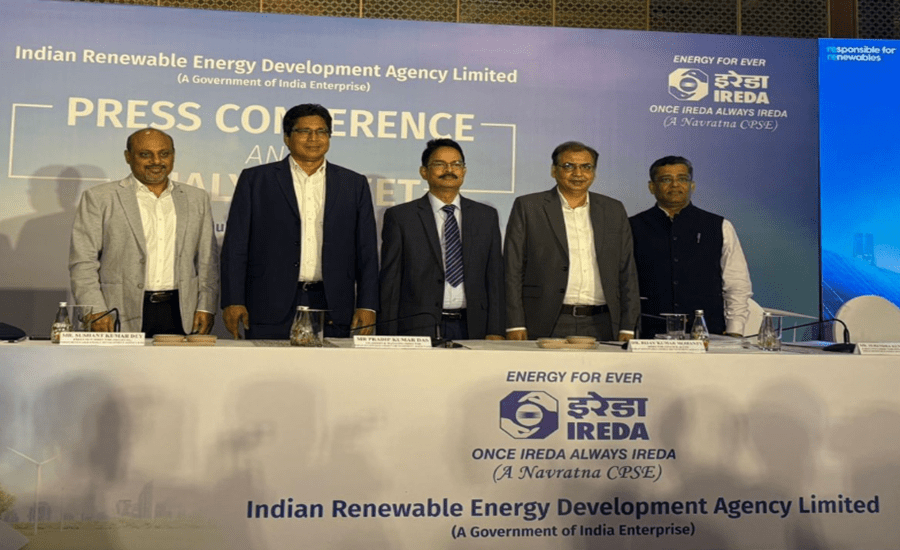

CMD Highlights Strategic Focus on Governance and Growth

Commenting on the results, Mr. Pradip Kumar Das, Chairman and Managing Director of IREDA, remarked, “Operational excellence and responsible financing remain at the heart of our strategy. We are committed to long-term stakeholder value through strong governance, financial discipline, and unwavering support for India’s renewable energy goals.”

Policy Boost: Tax Exemption on IREDA Bonds

In a significant policy milestone, the Central Board of Direct Taxes (CBDT) has notified IREDA bonds as ‘long-term specified assets’ under Section 54EC of the Income-tax Act. Effective July 9, 2025, this move enables investors to claim exemptions on capital gains tax, offering a dual advantage of tax benefits and green investment. This change is expected to lower capital costs for IREDA and expand its investor base.

Improved Asset Quality and National Recognition

Demonstrating its commitment to sound governance, IREDA has successfully reduced Non-Performing Assets (NPAs) by strengthening its credit appraisal and recovery systems. The organization’s leadership was further acknowledged when its CMD, Mr. Das, received the “CMA Icon 2025” award, and IREDA was ranked among the top five national wealth creators for FY 2023–24.

Driving India’s Renewable Energy Goals

India recently achieved 50% non-fossil fuel-based power capacity, surpassing its 2030 target five years ahead of schedule. As a key financing arm of this transition, IREDA is set to play a pivotal role in realising India’s ambitious 500 GW renewable energy target.

Through a combination of strong financials, sound governance, and strategic policy alignment, IREDA continues to strengthen its position as a cornerstone of India’s clean energy revolution.

About IREDA

IREDA, a government-owned non-banking financial institution under the Ministry of New and Renewable Energy, is dedicated to promoting and financing renewable energy and energy efficiency projects across India. Formed in 1987, IREDA is a Navratna organisation owned by the Government of India and administratively controlled by the Ministry of New and Renewable Energy (MNRE).