New Delhi: The Government of India has placed Mr Yogendra Kumar Mishra, a Joint Commissioner of Income Tax posted in Kashipur, under suspension with immediate effect, in connection with an ongoing criminal investigation.

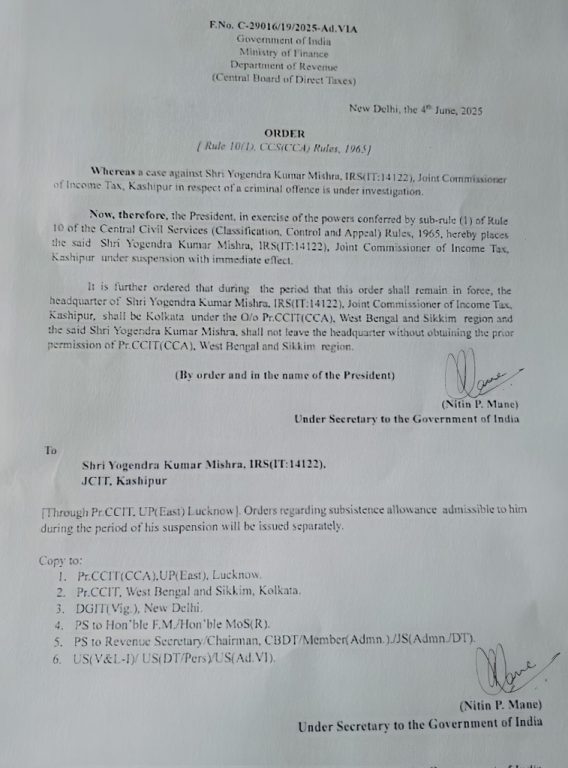

According to an official order issued by the Ministry of Finance, Department of Revenue (CBDT), the suspension has been invoked under Rule 10(1) of the Central Civil Services (Classification, Control and Appeal) Rules, 1965.

Criminal Offence Under Investigation

The order states that a case involving Mr Mishra, an IRS officer of the 2014 batch (IRS-IT:14122), is currently under investigation for a criminal offence. The nature of the offence has not been disclosed in the public domain through the order, but it is assumed to be linked to his recent scuffle with a junior officer in Lucknow. The decision to suspend Mr Mishra was made under the authority of the President of India.

Headquarters Shifted to Kolkata During Suspension

As part of the suspension conditions, Mr Mishra’s headquarters have been relocated to Kolkata, under the jurisdiction of the Principal Chief Commissioner of Income Tax (CCA), West Bengal and Sikkim region. He is prohibited from leaving headquarters without prior permission from the Pr.CCIT (CCA), reflecting the serious procedural and disciplinary oversight invoked during the probe.

“The President… hereby places the said Mr Yogendra Kumar Mishra… under suspension with immediate effect,” the official order states.

Administrative Action Reflects Stringent Oversight

The suspension under Rule 10(1) signifies interim action often taken by the government to ensure free and fair investigation and prevent any potential influence by the officer under scrutiny. The Central Board of Direct Taxes (CBDT) has not provided further details on the case, likely due to the sensitive and ongoing nature of the criminal probe.

Background of The Case: Allegations of Physical Assault During Official Meeting in Lucknow

The suspension follows the filing of a First Information Report (FIR) against Mr Mishra by Gaurav Garg, a 2016-batch IRS officer, currently posted in Lucknow as Deputy Commissioner of Income Tax.

IRS Garg alleged that Mr Mishra assaulted him during a departmental meeting on May 29, held at the Income Tax office in Lucknow.

According to the FIR registered at Hazratganj police station, Mishra allegedly launched a violent, premeditated attack involving attempted strangulation and an attempt to stab Garg with a broken glass tumbler during a closed-door meeting attended by senior officials. The altercation reportedly stemmed from a dispute over the captaincy of a departmental cricket team.

Charges Filed Under Multiple Sections

Based on the complaint, Mishra has been booked under several sections of the Bharatiya Nyaya Sanhita (BNS) including:

- 109(1) – Attempt to murder

- 121(2) – Causing hurt to a public servant

- 221 – Obstruction of duty

- 324(3) – Mischief

- 351(3) – Criminal intimidation

- 352 – Intentional insult

He has also been charged under relevant sections of the Prevention of Damage to Public Property Act, 1984.

Mr Mishra Claims Targeting Over Past Investigations

On June 2, Mishra posted a public statement on X (formerly Twitter) denying the allegations and asserting that he is being targeted for exposing irregularities in tax investigations during his predecessor’s tenure in Kanpur.

“I am forced to speak out publicly about the extreme harassment, character assassination, and false police complaints being orchestrated against me. The facts must be known,” he wrote.

1/17⁰THREAD: Legal rebuttal to the false & malicious FIR under Section 307 IPC filed against me, Yogendra Mishra, IRS, by Gaurav Garg, IRS — based solely on the documented legal arguments filed before the Hon’ble Court.@dgpup @myogiadityanath @DainikBhaskar @MamtaTripathi80

— yogendra mishra (@irsyogendra) June 2, 2025

The suspension of a senior Indian Revenue Service officer in an ongoing criminal investigation underscores the government’s commitment to maintaining discipline, transparency, and accountability within the civil services. Further details may emerge following the progress of the inquiry.