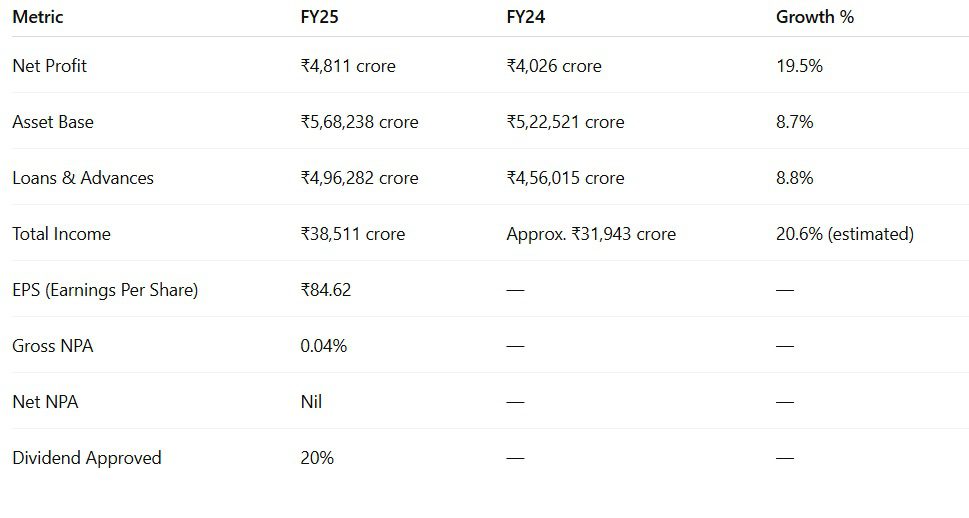

New Delhi: The Small Industries Development Bank of India (SIDBI) has reported a record-breaking net profit of ₹4,811 crore for the financial year 2024-25, marking a 19.5% increase from ₹4,026 crore in FY24.

SIDBI, headquartered in Lucknow, continues to assert its leadership in MSME financing, as the bank’s asset base crossed ₹5.6 lakh crore, growing 8.7% year-on-year, according to a statement released after its Annual General Meeting (AGM) held on Monday.

Key Financial Highlights (FY25)

Speaking after the AGM, SIDBI Chairman and Managing Director Manoj Mittal emphasized the bank’s mission to expand and empower India’s MSME ecosystem, with a strong focus on financial inclusion, digitization, and green financing.

“We enhance credit accessibility through innovative digital initiatives and loan products, such as the EXPRESS Loan, which leverages automated evaluations for faster approvals,” Mittal said.

He added that SIDBI remains committed to supporting MSMEs in their growth journeys, particularly in:

- Resilience building

- Global market expansion

- Cleaner production and green energy adoption

- SIDBI’s Lending and Growth Strategy

SIDBI noted a substantial increase in its loan and advances portfolio, which rose by 8.8% year-on-year to ₹4.96 lakh crore. The bank attributed this growth to:

- Digitally enabled loan disbursement tools

- Stronger partnerships with government and private sector stakeholders

- Targeted schemes for MSME development

The bank has also expanded its branch network significantly in FY25 and into FY26, aiming to further deepen credit penetration among underserved MSME clusters.

Read also: MSME Business Confidence Improves in April–June Quarter: SIDBI Survey

Green Finance & Climate Commitments

In line with India’s climate goals, SIDBI is also spearheading initiatives to mainstream green financing for small businesses.

The bank is promoting:

- Cleaner production technologies

- Energy-efficient infrastructure

- Renewable energy projects for MSMEs

This aligns with global sustainability trends and helps MSMEs reduce carbon footprints while improving competitiveness.

Summary

SIDBI’s robust FY25 performance reflects its strong financial fundamentals and strategic shift towards technology-driven lending, sustainable development, and inclusive financial access. With record profits, near-zero NPAs, and a fast-expanding loan book, SIDBI is poised to play an even greater role in strengthening India’s MSME backbone in the years ahead.

About SIDBI

The Small Industries Development Bank of India (SIDBI) is India’s principal financial institution established in 1990 to promote, finance, and develop the Micro, Small, and Medium Enterprise (MSME) sector. It serves as a Development Finance Institution (DFI), addressing financial and developmental gaps by providing financial assistance, policy support, and a range of services to enhance the competitiveness and growth of MSMEs. SIDBI also coordinates with other institutions and promotes sustainable practices, including energy efficiency and low-carbon transitions within the MSME sector.