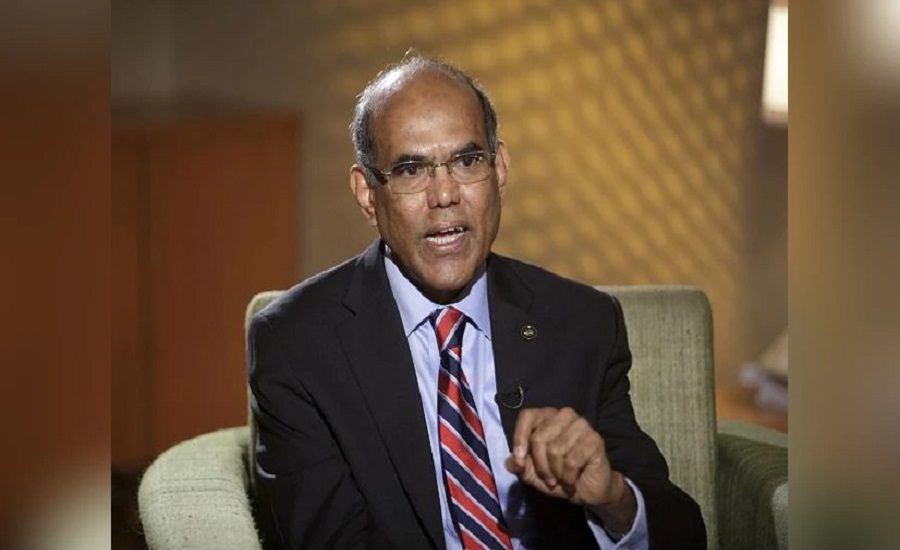

New Delhi: Former Reserve Bank of India (RBI) Governor D Subbarao has cautioned against letting the ‘Make in India’ initiative transform into a protectionist doctrine of ‘Make all that India needs,’ warning it could undermine investment inflows and long-term productivity.

In a wide-ranging interview with PTI, Subbarao underscored the need for competitiveness over self-sufficiency, especially amid the evolving global trade landscape and the US’s imposition of punitive tariffs on Indian exports.

‘Openness, Not Isolation, Drives Growth’

The ex-RBI Governor noted that US tariffs—reportedly up to 50% on Indian exports—pose a significant challenge to India’s ambitions of becoming a global manufacturing hub.

“If ‘Make in India’ degenerates into ‘Make all that India needs’, we risk losing the chance to attract investment away from China,” he warned.

“Openness, not isolation, is the path to sustainable growth.”

Read also: RBI Issues New 2025 Directions to Regulate AIF Investments by Banks and NBFCs

Tariffs Threaten India’s China+1 Strategy

India is now reportedly facing the highest tariff rates in Asia, surpassing those in Bangladesh (20%), Vietnam (20%), and Indonesia (19%), Subbarao pointed out. These elevated barriers, particularly from the US—India’s largest export destination—threaten the country’s “China+1” investment appeal.

The situation, he said, is likely to weaken India’s competitiveness in labor-intensive exports like textiles, leather, and gems & jewellery, which constitute nearly half of India’s exports to the US, contributing over 2% of India’s GDP.

Caution on Atmanirbhar Bharat Interpretation

While backing the Atmanirbhar Bharat vision, Subbarao clarified that self-reliance must be strategic, not absolute.

“It should mean strategic autonomy in areas like defence and energy, not blanket self-sufficiency that leads to inefficiencies or inward-looking policies,” he said.

He emphasized that ‘Make in India’ was originally aimed at making the country a global manufacturing hub—not just serving domestic needs, but also catering to international markets.

India-US Trade Pledge at Risk

Subbarao cast doubt over the feasibility of the joint India-US goal to triple bilateral trade to $500 billion by 2030, citing rising protectionist sentiments and lack of progress on market access negotiations.

He warned that Chinese dumping into global markets, in response to US restrictions, could further damage Indian exports by crowding out India in third-country markets.

Strategic Flexibility Needed on Agriculture and Dairy

On the sensitive issue of allowing US access to India’s agriculture and dairy sectors, Subbarao advised “calibrated flexibility” rather than blanket openings.

“Agriculture and dairy are politically and economically sensitive sectors in India. But some phased, targeted concessions could help move stalled negotiations forward,” he said.

He proposed tools such as limited tariff-rate quotas, sanitary alignment, and support for Indian farmers as a way to balance domestic interests with trade ambitions.

Russian Oil Diversification Needs Gradual Approach

On the energy front, Subbarao advised gradual diversification of crude oil sources rather than an abrupt shift from Russian imports, which could spike global oil prices, weaken the rupee, and worsen the current account deficit.

“Since Russian oil discounts have narrowed to $5/barrel, switching may seem less painful, but sudden moves would still destabilize the energy market,” he noted.

Negotiation with the US: Focus on Comparative Advantages

On the impasse in India-US trade talks, Subbarao said India’s strategy should be rooted in pragmatism, identifying win-win sectors, and resisting emotional or politically charged decisions.

“India must push for preferential access in labor-intensive sectors and offer selective concessions where necessary,” he concluded.