New Delhi: India’s largest energy public sector enterprise, Indian Oil Corporation Limited (IndianOil), has reported its best-ever first-half (H1) performance for FY 2025–26, with record-breaking achievements across sales, refining throughput, and profitability.

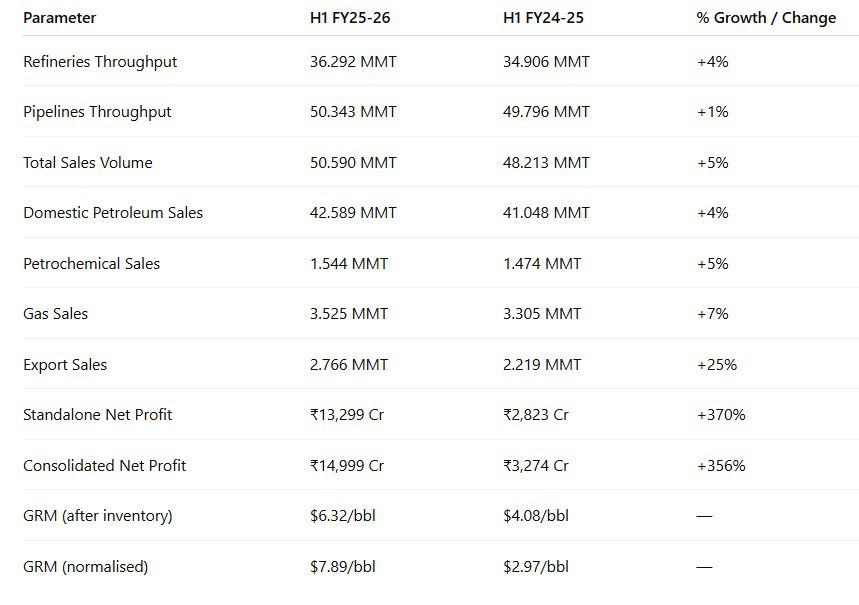

According to the company’s financial results for April–September 2025, IndianOil’s standalone net profit surged to ₹13,299 crore, a nearly fivefold increase from ₹2,823 crore in the same period last year. The company’s Revenue from Operations rose to ₹4,21,600 crore, up from ₹4,11,138 crore in H1 FY 2024–25.

At the group level, IndianOil’s Revenue from Operations reached ₹4,28,297 crore, while its consolidated net profit climbed to ₹14,999 crore, reflecting a strong performance across subsidiaries.

Record Sales and Operational Excellence

IndianOil achieved its highest-ever H1 sales volume of 50.590 million metric tonnes (MMT), marking a 5% growth over the previous year’s 48.213 MMT.

Domestic petroleum product sales rose 4%, outpacing the industry growth rate of 3.9%. Notably, institutional High-Speed Diesel (HSD) sales surged by 35.7%, significantly higher than the industry’s 12.8% growth.

In the petrochemicals segment, sales volumes grew 5% to 1.544 MMT, while gas sales rose 7% to 3.525 MMT. Export sales recorded a sharp 25% increase, reaching 2.766 MMT, up from 2.219 MMT last year.

Read also: Indian Oil to Procure 10 Crude Tankers from SCI-Led JV, Vessels to Be Built at Indian Shipyards

Refining and Pipeline Performance

IndianOil’s refinery throughput for the period stood at 36.292 MMT, a 4% increase over the previous year’s 34.906 MMT, with capacity utilisation at 103% — reaffirming its operational efficiency.

The company’s cross-country pipelines network, which serves as the energy lifeline of India, recorded a throughput of 50.343 MMT, up 1% from 49.796 MMT during the same period last year.

Strong Refining Margins and Improved Efficiencies

IndianOil reported a Gross Refining Margin (GRM) of $6.32 per barrel, compared to $4.08 per barrel in H1 FY 2024–25. The normalised GRM (excluding inventory effects) was even higher at $7.89 per barrel, versus $2.97 per barrel last year.

The surge in profitability was driven by higher refining and marketing margins, operational efficiencies, and product mix optimisation, underscoring the company’s strategic focus on sustainable profitability.

“A Testament to IndianOil’s Resilience and Leadership”

Commenting on the record performance, Saurabh Dutt, Executive Director (Corporate Communications & Branding) at IndianOil, said:

“Achieving the highest-ever sales volume and substantial profit growth underscores IndianOil’s leadership in India’s energy sector and its commitment to fueling the nation’s growth journey.”

He added that the results reflect IndianOil’s strategic agility, operational excellence, and customer-centric approach amid evolving energy dynamics.

Performance Summary (H1 FY 2025–26 vs H1 FY 2024–25)

Powering India’s Energy Future

With consistent capacity utilisation, expanding petrochemical and gas portfolios, and a growing export footprint, IndianOil continues to play a pivotal role in strengthening India’s energy security.

The company’s performance aligns with the nation’s Viksit Bharat 2047 vision, driving sustainable industrial growth, infrastructure expansion, and energy accessibility for all.

About IOCL

Indian Oil Corporation Limited (IOCL) is India’s largest state-controlled oil and gas company, a ‘Maharatna’ Public Sector Undertaking with interests spanning the entire hydrocarbon value chain, including refining, pipelines, and marketing. It operates refineries, a vast pipeline network, and a wide network of retail outlets and service stations across India. The company also has business interests in petrochemicals, exploration, and production.