In a major move to address the financial challenges faced by Rashtriya Ispat Nigam Limited (RINL), also known as Vizag Steel, the Indian government has approved an equity infusion of Rs. 11,440 crore. This decision aims to stabilize the company’s operations, reduce its debt burden, and secure its position in the highly competitive steel market.

RINL has been grappling with significant losses, rising debt, and inefficiencies in its operations. As of March 31, 2024, the company’s net worth was negative, standing at Rs. (-)4538 crore. With mounting liabilities and exhausted borrowing capacity, RINL’s financial condition has become precarious, making the government’s intervention essential to avoid its collapse.

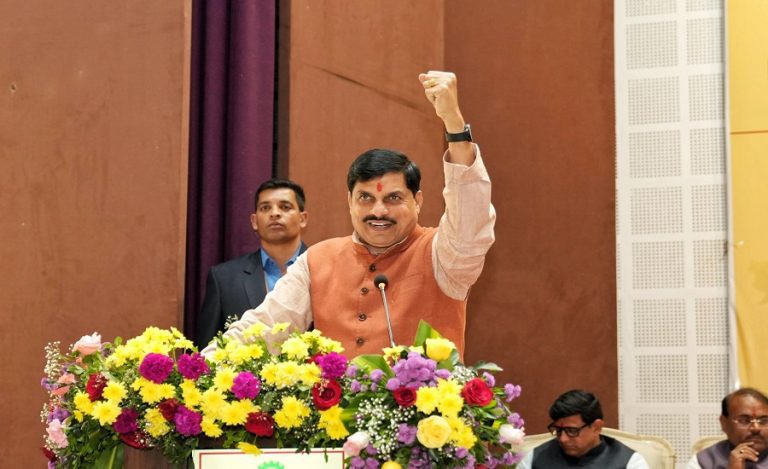

In response to concerns raised in the Rajya Sabha, Bhupathiraju Srinivasa Varma, Minister of State in the Steel Ministry, reiterated that the government periodically reviews public sector undertakings (PSUs) and takes necessary steps to support them. RINL, along with Steel Authority of India Limited (SAIL) and NMDC Steel Ltd (NSL), are the three major public-sector steel manufacturers in India.

Regarding the possibility of merging these entities, Minister Varma stated that, at present, there are no plans to merge SAIL, NMDC Steel, and RINL. However, in September 2024, the Steel Ministry announced that it is actively considering the merger of RINL with SAIL, as part of efforts to improve operational efficiency and financial stability.

RINL, located in Visakhapatnam, Andhra Pradesh, is India’s first shore-based integrated steel plant. Despite its vital role in domestic and industrial steel production, the company has struggled to meet its financial obligations, facing stiff competition due to fluctuating steel prices and rising operational costs.

The Rs. 11,440 crore equity infusion is a critical step in revitalizing Vizag Steel, allowing it to service its debts, regain financial stability, and remain competitive. With the infusion, the company is expected to overcome its financial crises and continue its role in India’s steel sector.

The Indian government’s decision highlights its commitment to ensuring the sustainability of key public-sector enterprises and their continued contribution to India’s economic growth.