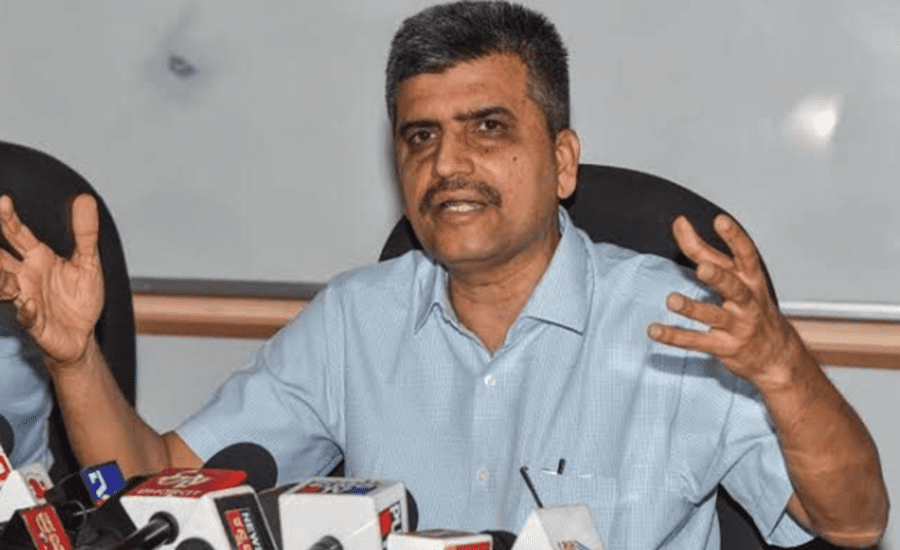

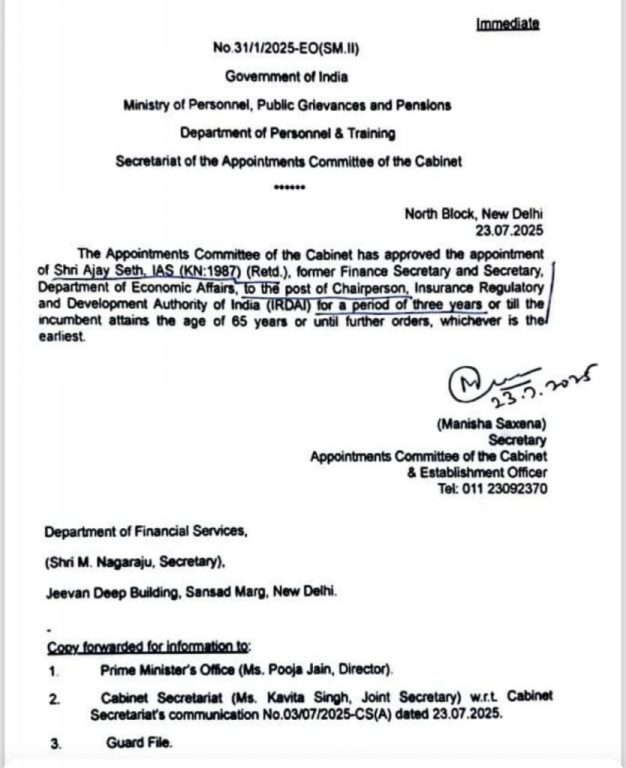

New Delhi: The Appointments Committee of the Cabinet has approved the appointment of Ajay Seth, a retired 1987-batch Indian Administrative Service (IAS) officer and former finance secretary, as the Chairperson of the Insurance Regulatory and Development Authority of India (IRDAI). Seth takes over for a three-year term or until the age of 65, whichever comes earlier.

His appointment ends a nearly four-month leadership vacuum at the top of India’s insurance regulatory body following the departure of Debasish Panda in March.

read also: Race for IRDAI Chairman: IAS Ajay Seth, Giridhar Aramane, and Sriram Taranikanti Lead the Contenders

A Technocrat With Deep Economic Credentials

Mr Seth becomes the sixth IAS officer to head IRDAI. With a long and distinguished career in economic policymaking, Seth brings considerable experience to the role. He most recently served as Finance Secretary, and earlier as Secretary of the Department of Economic Affairs. He briefly held additional charge of the Revenue Department, overseeing both direct and indirect tax systems.

Seth has also held international and infrastructure-oriented roles, including a tenure at the Asian Development Bank and a leadership position with the Bangalore Metro Rail Project.

Architect of Post-COVID Macroeconomic Strategy

During the COVID-19 recovery phase, Seth played a central role in crafting India’s macroeconomic response. He was instrumental in:

- Formulating Union Budgets

- Issuing Sovereign Green Bonds

- Driving Infrastructure Finance Initiatives

His appointment to IRDAI signals the government’s intent to revive and fast-track reforms in the insurance sector, many of which have remained stagnant due to leadership vacuum and regulatory bottlenecks.

Key Challenges: Reform Backlog and Consumer Trust Deficit

Mr Seth’s tenure begins under significant pressure to deliver overdue reforms and improve public trust in the insurance ecosystem. Several flagship projects are delayed:

- Bima Sugam: A digital one-stop platform for policy comparison and claims, has missed its launch timeline.

- Bima Vistaar: Aimed at providing bundled insurance for rural areas, faces technical and governance hurdles.

- Bima Vahaak: Envisioned as a women-led distribution model, is yet to take off.

Major regulatory overhauls, including the transition to a risk-based capital regime and adoption of international accounting standards, remain stalled due to industry unreadiness.

read also: Who is IAS Ajay Seth, Appointed as the New Finance Secretary of India?

Pending Big-Ticket Policy Decisions

Mr Seth is also expected to steer progress on several structural reforms that are currently in limbo:

- 100% FDI in insurance

- Composite licenses for life and general insurance under a single entity

- Differentiated capital norms based on insurer size and product mix

- Listing of public sector insurers—a politically and operationally sensitive issue

Meanwhile, solvency issues at three state-run insurers have added to IRDAI’s regulatory burdens.

Industry Practices Under Scrutiny

Both the Finance Ministry and the Reserve Bank of India have raised concerns over mis-selling practices, particularly bundled products being pushed by banks and car dealers. Consumers have also voiced frustrations over:

- Opaque claim settlement processes

- Low portability in health insurance

- Lack of cost transparency

There is growing demand for IRDAI to replicate the transparency reforms of the mutual fund sector, which successfully rebuilt investor confidence.

A Crucial Moment for Insurance Sector Reorientation

Ajay Seth steps into IRDAI at a critical juncture, where growth in the insurance sector has started to flatten and public trust is eroding. His core challenge will be to:

- Reignite reform momentum

- Clarify the long-term regulatory roadmap

- Ensure inclusivity and transparency

- Improve product quality and accountability

Seth’s deep economic understanding and prior experience in both government and development institutions may prove pivotal in steering the insurance industry back toward stability, growth, and inclusion.