New Delhi – In a significant step towards enhancing financial inclusion across India’s rural landscape, the Life Insurance Corporation of India (LIC) has signed a Memorandum of Understanding (MoU) with the Department of Rural Development, Ministry of Rural Development, Government of India. The partnership seeks to promote the Bima Sakhi Yojana—a women-centric insurance distribution scheme designed to foster self-reliance and financial independence among women in remote areas.

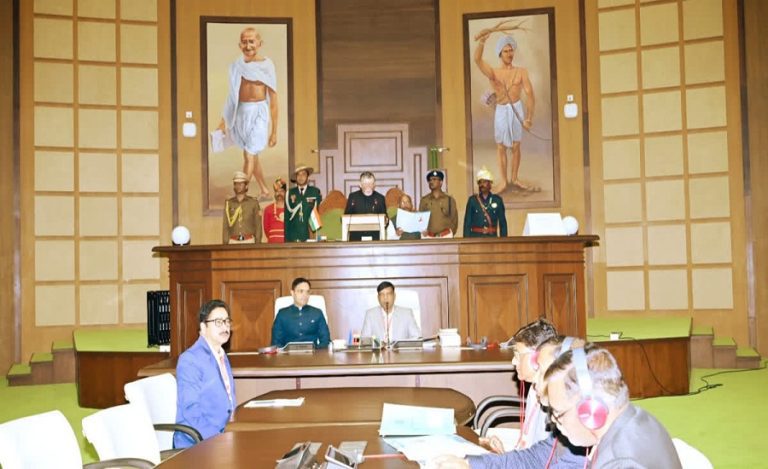

The MoU was formally inked during the Ministry’s National Conclave on Financial Inclusion, Anubhuti, held in Goa from July 8 to 10, 2025.

Empowering Women, Strengthening Communities

Bima Sakhi Yojana, a flagship LIC initiative, offers women a platform to build a career as LIC agents with exclusive stipendiary and performance-based benefits. The program enables women to earn through insurance sales while enjoying all rights and benefits available to regular LIC agents.

Under the scheme, eligible women are provided monthly stipends of ₹7,000 in the first agency year, ₹6,000 in the second, and ₹5,000 in the third—subject to fulfilling certain criteria. The aim is to not only create income opportunities but also instill long-term financial confidence among women, thereby empowering households at the grassroots level.

Also Read: LIC Ties Up with AU Bank to Boost Life Insurance Access Across India – Details Inside

In Sync with Rural Development Goals

The collaboration aligns closely with the objectives of the Deendayal Antyodaya Yojana – National Rural Livelihoods Mission (DAY–NRLM), which focuses on improving livelihoods through skill-building and income-generating opportunities. By integrating the Bima Sakhi Yojana with DAY–NRLM’s outreach, the government and LIC aim to expand insurance awareness while uplifting rural families economically.

According to LIC, this MoU marks a strategic milestone in its ongoing effort to bridge the urban-rural insurance divide, with special emphasis on inclusive development.

About LIC

The Life Insurance Corporation of India is the country’s largest government-owned insurance and investment corporation. With a vast network of agents and policyholders, LIC continues to play a pivotal role in ensuring financial security across India’s diverse population.

Also Read: R Doraiswamy Recommended as Next CEO & MD of Life Insurance Corporation of India (LIC) by FSIB