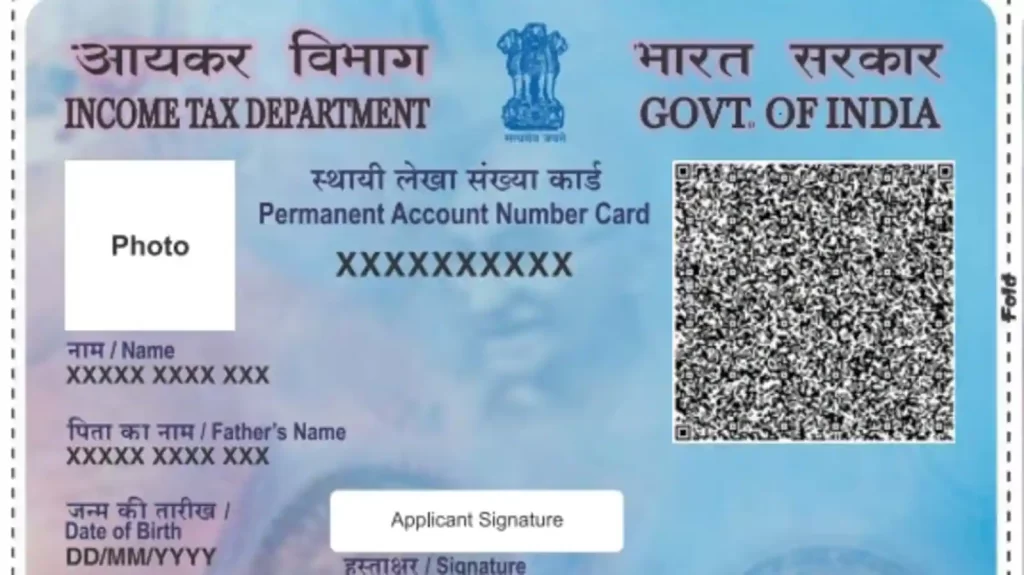

New Delhi: In a major step towards strengthening India’s digital financial ecosystem, the Government of India has introduced new PAN Card rules in 2025, bringing sweeping changes that directly impact crores of PAN card holders. The reforms aim to enhance transparency, reduce duplication, curb tax evasion, and simplify identity verification across banking, taxation, and government services.

With automatic Aadhaar linking, instant e-PAN issuance, free digital signatures, and expanded use of PAN as a universal identity document, the new rules mark a significant shift in how individuals and institutions interact with India’s tax and digital governance framework.

Background of PAN Card New Rules 2025

The Permanent Account Number (PAN), issued by the Income Tax Department, has long been a cornerstone of India’s financial and tax system. It is mandatory for:

- Filing income tax returns

- Opening bank and demat accounts

- High-value transactions above ₹50,000

- Property purchases, investments, and loans

However, over the years, authorities identified challenges such as:

- Duplicate or fake PAN cards

- Manual verification delays

- Errors in linking PAN with Aadhaar

- Limited digital usability

As India accelerates toward a Digital India and faceless governance model, the government decided to modernize PAN infrastructure to make it more secure, faster, and citizen-friendly.

PAN Card New Rules 2025: Automatic Aadhaar–PAN Linking Becomes Mandatory

One of the most significant changes under the PAN Card New Rules 2025 is the automatic Aadhaar linking mechanism.

- Any new PAN issued in 2025 will be automatically linked with Aadhaar

- Manual linking will no longer be required for new applicants

- Existing PAN holders must ensure Aadhaar linkage to keep PAN active

Importance of PAN Card New Rules 2025

- Eliminates duplicate PAN cards

- Reduces identity fraud

- Saves time and prevents errors

- Strengthens the national taxpayer database

Failure to link Aadhaar with PAN may result in PAN becoming inoperative, affecting banking and tax-related transactions.

PAN Card New Rules 2025: Instant e-PAN Issuance in Minutes

The government has also introduced a real-time e-PAN generation system, allowing applicants to receive their PAN digitally within minutes.

Key Highlights

- e-PAN issued instantly after Aadhaar verification

- Delivered via email in PDF format

- Valid for all financial, legal, and tax purposes

- No physical paperwork required

This reform significantly reduces waiting periods and improves access, especially for first-time taxpayers, students, and rural applicants.

Free Digital Signature for PAN Holders

In a major digital empowerment move, the government has introduced free digital signature functionality for PAN card holders.

Benefits of Digital Signature

- Sign documents electronically without physical presence

- Valid for online forms, banking, tax filings, and government portals

- Reduces dependency on physical signatures

This feature will simplify processes such as:

- Online loan applications

- Company registrations

- Income tax submissions

- Government service applications

PAN as a Universal Identity Document

Under the 2025 reforms, PAN is being positioned beyond taxation — as a universal identity proof.

- Expanded Use of PAN

- Banking and financial services

- Real estate transactions

- Education and scholarships

- Government welfare schemes

- Private sector KYC verification

This move aligns PAN with India’s “One Nation, One Identity” vision, reducing the need to submit multiple documents for different services.

Stronger Compliance and Penalties

The new rules also introduce stricter compliance requirements to ensure system integrity.

- What PAN Holders Must Be Careful About

- Using multiple PAN cards is punishable

- Inaccurate or mismatched details may trigger scrutiny

- Non-linked PANs may be suspended

Authorities have made it clear that misuse or non-compliance could attract financial penalties and legal consequences under the Income Tax Act.

PAN Card New Rules 2025: What PAN Holders Should Do Now

To stay compliant, individuals should:

- Verify PAN–Aadhaar linkage

- Update incorrect personal details

- Download and securely store e-PAN

- Avoid applying for duplicate PAN cards

Staying proactive will help avoid disruptions in banking, taxation, and investment activities.