New Delhi: The Pension Fund Regulatory and Development Authority (PFRDA) has unveiled a series of policy reforms aimed at strengthening the National Pension System (NPS). The reforms are designed to enhance competition, expand participation, and improve retirement outcomes for subscribers across government, corporate, retail, and gig-economy segments.

Scheduled Commercial Banks Can Sponsor Pension Funds

Under the new framework, Scheduled Commercial Banks (SCBs) will be allowed to independently set up Pension Funds to manage NPS accounts. This move addresses existing regulatory constraints that had previously limited bank participation.

Key highlights of the framework:

- Eligibility criteria will be based on net worth, market capitalization, and prudential soundness in line with RBI norms.

- Only well-capitalized and systemically robust banks will be permitted to sponsor Pension Funds.

- The detailed criteria will apply to both new and existing Pension Funds and will be notified separately.

The decision is expected to increase competition, ensure better governance, and safeguard subscriber interests.

Read also: Big Relief for Retirees: Supreme Court Flags Finance Act 2025 in Landmark Pension Parity Case

Appointment of New Trustees to NPS Trust Board

PFRDA has appointed three new Trustees to the Board of NPS Trust following a formal selection process:

- Dinesh Kumar Khara, Former Chairman, State Bank of India – designated as Chairperson of the NPS Trust Board

- Ms. Swati Anil Kulkarni, Former Executive Vice President, UTI AMC – Trustee

- Dr. Arvind Gupta, Co-Founder and Head, Digital India Foundation and Member of the National Venture Capital Investment Committee under SIDBI’s Fund of Funds Scheme

These appointments are expected to strengthen governance, strategic oversight, and stakeholder confidence in the NPS ecosystem.

Revision of Investment Management Fee (IMF)

To align with subscriber expectations, international benchmarks, and expanding coverage, PFRDA has revised the Investment Management Fee (IMF) structure for Pension Funds, effective 1 April 2026.

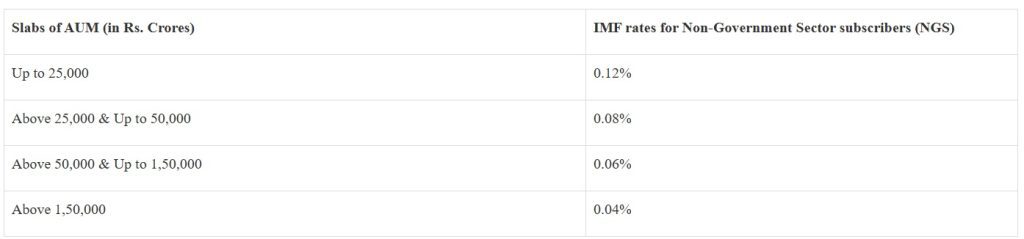

The new slab-based IMF for Non-Government Sector (NGS) subscribers is as follows:

Government sector IMF for employees under Composite Scheme, Auto Choice, and Active Choice G 100s remains unchanged.

The Annual Regulatory Fee (ARF) of 0.015% remains the same, with 0.0025% of AUM passed to the Association of NPS Intermediaries (ANI) for awareness, outreach, and financial literacy initiatives.

These changes aim to enhance transparency, align fees with asset size, and ensure cost-effectiveness for subscribers.

Focus on Subscriber Benefits and NPS Growth

The policy reforms by PFRDA are expected to:

- Facilitate greater access to well-governed Pension Funds.

- Encourage competitive and resilient NPS management.

- Improve long-term retirement outcomes and old-age income security.

- Support the expansion of NPS coverage across corporate, retail, and gig-economy segments.

Officials noted that the reforms are part of PFRDA’s continued efforts to formalize financial savings and retirement planning across India, ensuring that all subscribers benefit from efficient, transparent, and sustainable pension solutions.

Read also: CM Pushkar Singh Dhami Reaffirms Commitment to Soldiers’ Welfare at Dehradun Ex-Servicemen Meet