New Delhi: The Pradhan Mantri Jan Dhan Yojana (PMJDY), launched by Prime Minister Narendra Modi on 28 August 2014, has completed 11 years. Recognised as the world’s largest financial inclusion programme, PMJDY has transformed access to banking for millions of underserved citizens across India.

Financial Inclusion as a Driver of Growth

Union Finance Minister Nirmala Sitharaman marked the occasion with a message highlighting the mission’s impact. “Financial inclusion is a key driver of economic growth and development. Universal access to bank accounts enables the poor and marginalised to participate fully in the formal economy,” she said.

She noted that PMJDY has become a major channel for Direct Benefit Transfer (DBT), extending credit, social security, and savings. More than 56 crore accounts have been opened, mobilising deposits worth ₹2.68 lakh crore. Over 38 crore RuPay debit cards have been issued to support digital transactions.

Women and Rural India at the Centre

Sitharaman underlined that 67% of PMJDY accounts are in rural and semi-urban areas, while 56% are held by women. “This shows how the most disadvantaged sections have been brought into the formal financial sector,” she said.

Minister of State for Finance Pankaj Chaudhary called PMJDY one of the most successful financial inclusion initiatives in the world. “The Jan Dhan Yojana is about dignity, empowerment and opportunity,” he said.

Reaching Every Household

Chaudhary recalled the Prime Minister’s 2021 Independence Day call for universal access to bank accounts, insurance, and pension coverage. He noted that saturation drives have brought India close to achieving this goal.

A nationwide campaign is underway until 30 September 2025 to open new accounts, update KYC details, and enrol citizens under Jansuraksha schemes. Over 1.77 lakh camps have already been held across districts.

Features of PMJDY Accounts

PMJDY offers zero-balance accounts with no maintenance charges. Each account includes a free RuPay debit card with an accident insurance cover of ₹2 lakh and an overdraft facility of up to ₹10,000. The scheme ensures no restriction on deposits and provides at least four free monthly withdrawals, including from ATMs.

Building a Financially Inclusive Society

Over 11 years, PMJDY has become a cornerstone for transparent and corruption-free DBT. In FY 2024-25 alone, ₹6.9 lakh crore was credited directly into beneficiary accounts under various schemes.

The programme also supports life and accident insurance through Jan Suraksha schemes, extending coverage to millions in the unorganised sector. By integrating with Aadhaar and mobile platforms under the JAM trinity, PMJDY has created a diversion-proof system for subsidy delivery.

Milestones and Achievements

As of 13 August 2025, PMJDY has achieved the following milestones:

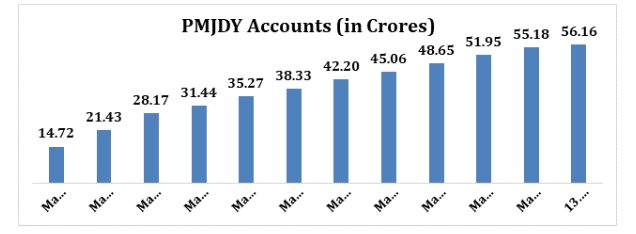

A. PMJDY Accounts – 56.16 crore

Out of these, 55.7% (31.31 crore) are held by women, and 66.7% (37.48 crore) are in rural and semi-urban areas.

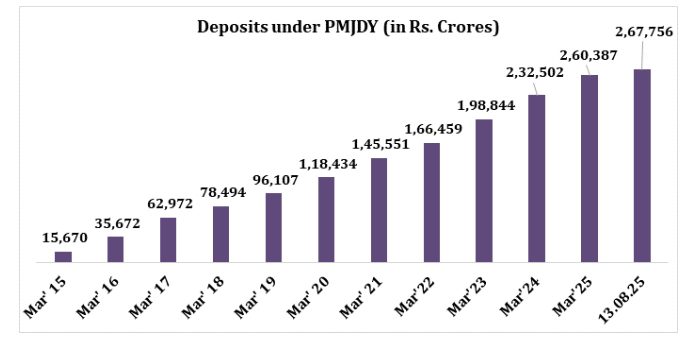

B. Deposits – ₹2.68 Lakh Crore

Deposits under PMJDY accounts have reached ₹2,67,756 crore, a twelve-fold increase since 2015.

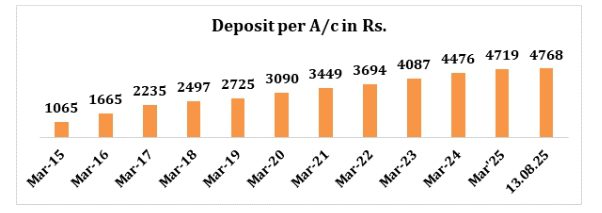

C. Average Deposit – ₹4,768 per account

The average deposit has increased 3.7 times compared to August 2015, reflecting greater usage and saving habits.

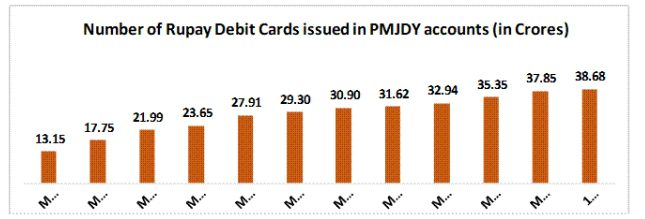

D. RuPay Debit Cards – 38.68 crore issued

Widespread RuPay card usage has driven digital transactions, with UPI transactions alone rising to 18,587 crore in FY 2024-25.

A Mission in Governance

PMJDY’s success stems from its mission-mode approach, digital infrastructure, and regulatory support. It has enabled savings, credit access, and financial empowerment for those once excluded. As the scheme enters its 12th year, it continues to stand as a model of inclusive growth and digital innovation.